Crypto in Your Retirement Fund: A High-Stakes Gamble or Smart Strategy?

Crypto in Your 401(K): A Smart Investment Strategy or Risky Gamble?

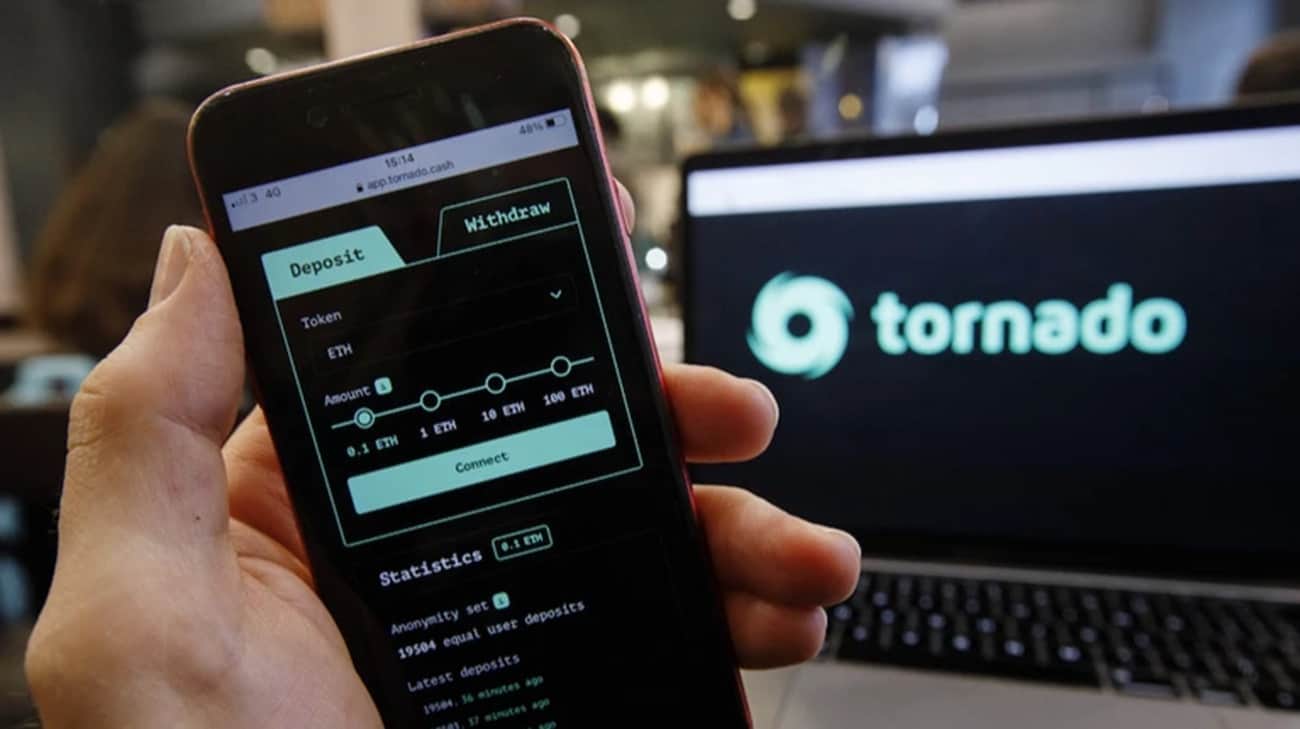

As the digital currency landscape continues to evolve, investors are increasingly asking a critical question: Should cryptocurrency find a place in their retirement portfolios? Financial experts from Seeking Alpha have weighed in on this complex and controversial topic.

Understanding the Potential and Pitfalls

Cryptocurrency represents a cutting-edge investment opportunity that promises high returns but comes with significant volatility. While traditional 401(K) accounts have historically focused on stocks, bonds, and mutual funds, the emergence of digital assets has opened new doors for forward-thinking investors.

Key Considerations Before Investing

- Assess your risk tolerance

- Understand the regulatory landscape

- Consider cryptocurrency's potential for portfolio diversification

- Evaluate the long-term growth potential

Expert Recommendations

Seeking Alpha analysts suggest a cautious approach: allocate a small percentage of your retirement portfolio to cryptocurrency—typically between 1% to 5%—to balance potential gains with managed risk.

Remember, while cryptocurrency offers exciting possibilities, it should be approached with careful research, strategic planning, and a comprehensive understanding of your personal financial goals.