Financial Future at Stake: Colorado Pushes for Mandatory Money Smarts in High School Diplomas

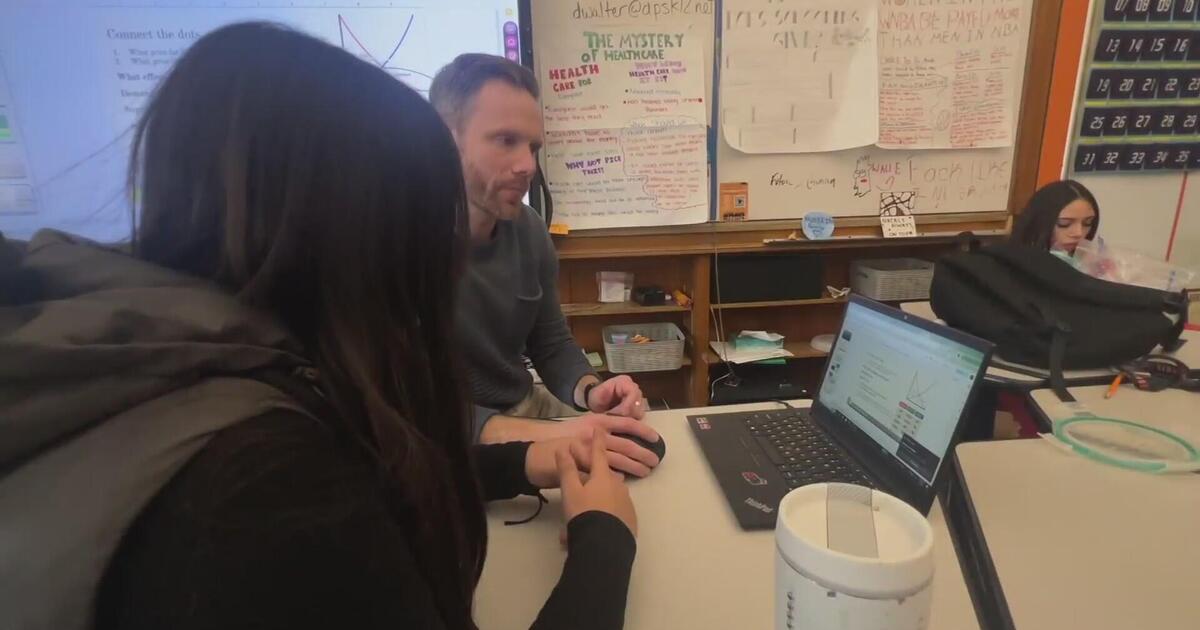

In a state known for its progressive education approaches, Colorado is falling short when it comes to financial literacy. A startling statistic reveals that merely one-quarter of school districts across the state mandate personal finance courses as a graduation requirement. This gap leaves thousands of students potentially unprepared for the complex financial challenges they'll face in adulthood.

While financial education is increasingly recognized as a critical life skill, most Colorado students are graduating without comprehensive training in managing money, understanding credit, budgeting, or making informed financial decisions. The limited implementation of personal finance curriculum means many young adults enter the workforce and independent life without essential financial knowledge.

Educators and financial experts argue that integrating personal finance into high school graduation requirements could significantly improve students' long-term financial health and economic stability. By equipping young people with practical money management skills early on, schools can help break cycles of financial uncertainty and empower the next generation to make smarter financial choices.

As the economic landscape becomes increasingly complex, the need for robust financial education has never been more urgent. Colorado has an opportunity to transform its approach and ensure that all students, regardless of their district, gain the financial literacy skills necessary to navigate their financial futures successfully.