AI Breakthrough: martini.ai Unveils Financial Wizard That Crunches Credit Risk in Seconds

In a groundbreaking leap for financial intelligence, martini.ai Financial Agents is revolutionizing how credit professionals assess corporate financial landscapes. The innovative AI-powered platform empowers financial experts to gain instantaneous, comprehensive insights into a company's fiscal well-being with unprecedented precision and speed.

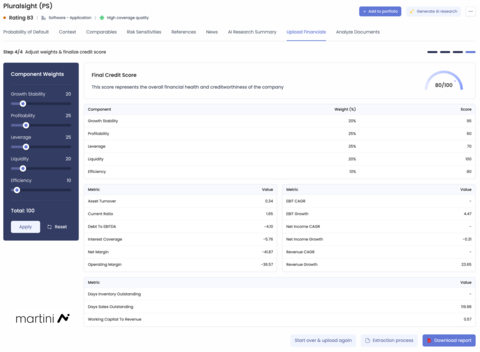

By harnessing cutting-edge artificial intelligence technology, martini.ai provides credit professionals with a dynamic, real-time dashboard that transforms complex financial data into actionable intelligence. Professionals can now make more informed decisions, quickly evaluating a company's financial health with remarkable depth and accuracy.

The platform's advanced algorithms analyze multiple financial indicators, delivering nuanced perspectives that go beyond traditional assessment methods. Credit experts can now leverage sophisticated AI-driven analysis to uncover hidden financial trends and potential risks with remarkable efficiency.

Launched in Palo Alto, California, martini.ai represents the next generation of financial intelligence tools, bridging the gap between complex data and strategic decision-making in the rapidly evolving world of corporate finance.