Banking Bombshell: Australians Uncover Shocking Cash Withdrawal Challenges in High-Stakes Gamble

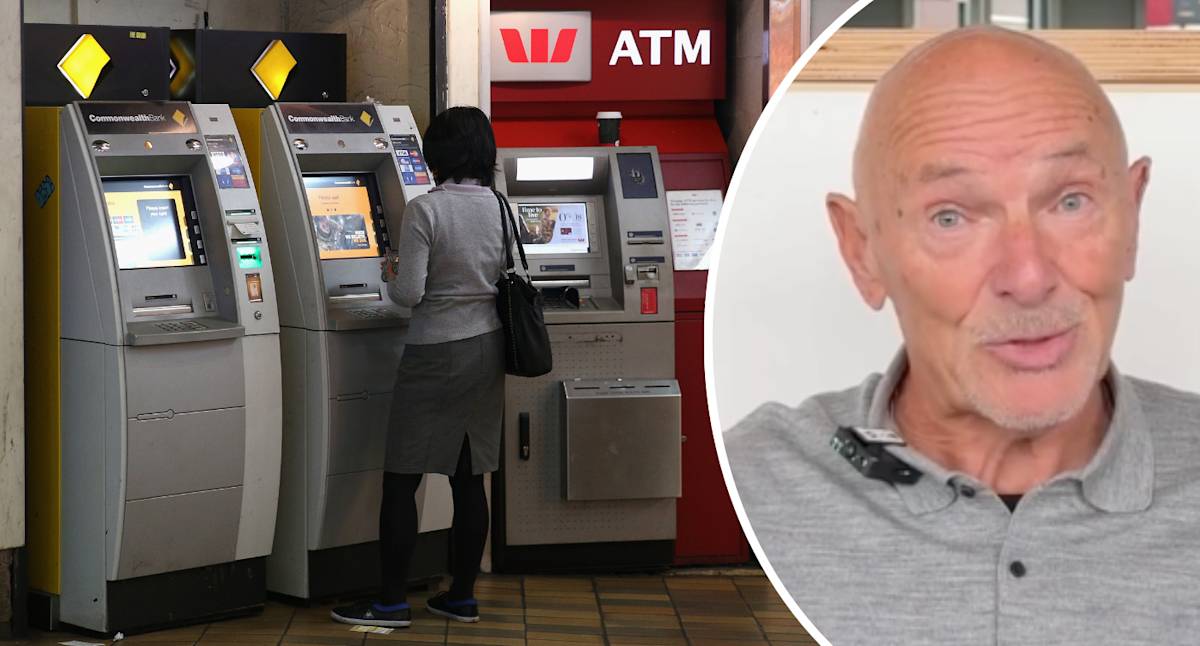

In an era of increasing financial scrutiny, banks have become increasingly invasive about your personal financial decisions. Gone are the days when your money was truly your own, with financial institutions now demanding detailed explanations about how you intend to use your hard-earned cash.

This new reality of banking is more than just a minor inconvenience—it's a fundamental shift in how financial institutions interact with their customers. Whether you're making a large withdrawal, transferring funds, or simply managing your everyday transactions, banks are now treating every monetary movement as a potential red flag.

The constant questioning might feel intrusive and frustrating, but it's a trend that's here to stay. Driven by regulatory requirements, anti-money laundering protocols, and heightened security measures, banks are more vigilant than ever about tracking and understanding the flow of money.

Customers are left with little choice but to adapt to this new landscape of financial transparency. What was once a private matter between an individual and their bank account has transformed into a detailed interrogation of personal financial choices.

While these practices may feel uncomfortable, they represent a broader effort to prevent financial fraud and protect both consumers and financial institutions. The challenge for customers is learning to navigate this new environment with patience and understanding.