Banking Boom: European Lenders Ride Highest Wave of Success Since 2008 Crash

European Banking Stocks Continue Remarkable Surge in 2023

European banking stocks are experiencing an extraordinary rally that shows no signs of slowing down, marking one of the most impressive financial performances in recent years. The Stoxx 600 Banks Index has delivered a stunning 25% increase in 2023, representing its strongest quarterly performance since 2020.

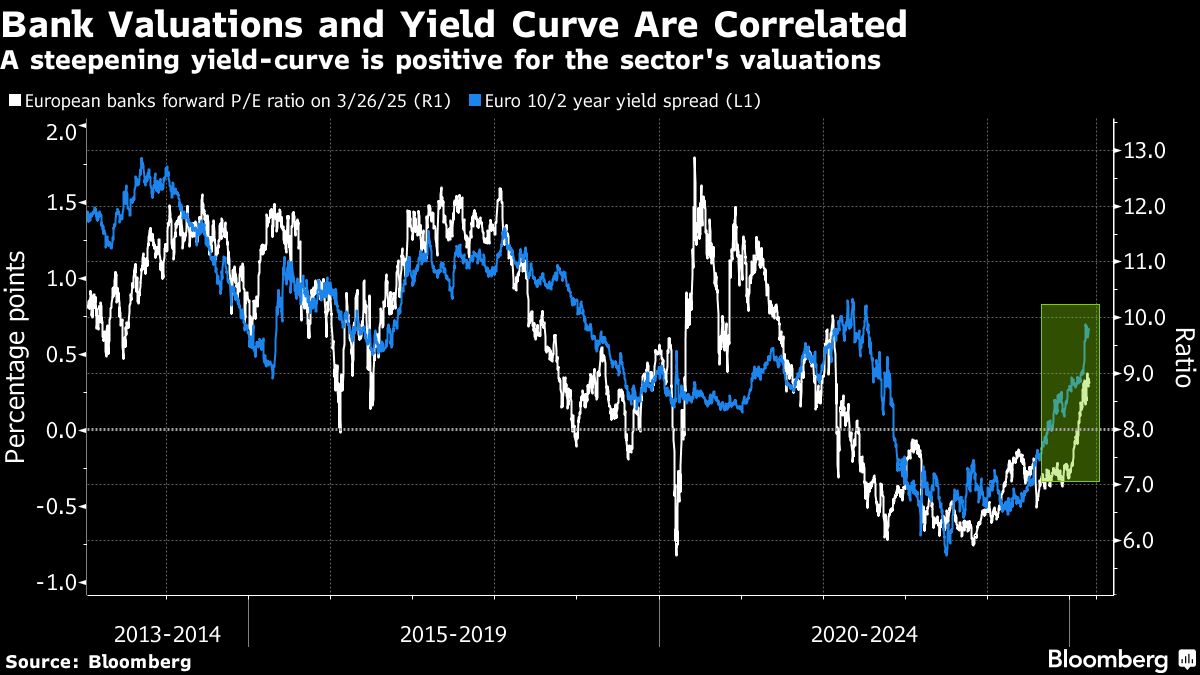

This remarkable growth reflects renewed investor confidence in the European banking sector, driven by improving economic conditions, strategic restructuring, and potential interest rate increases. Financial institutions across the continent are demonstrating resilience and adaptability in a complex economic landscape.

Investors and market analysts are closely watching this trend, seeing it as a potential indicator of broader economic recovery and stability in European financial markets. The sustained momentum suggests that banks have successfully navigated challenging post-pandemic conditions and are positioning themselves for future growth.

Key factors contributing to this impressive rally include:

- Improved banking sector profitability

- Stronger capital reserves

- Positive economic outlook

- Potential for higher interest rates

As the year progresses, market experts will be monitoring whether this exceptional performance can be maintained and what implications it might have for the broader European economic landscape.