Bitcoin's Price Plunge: A Golden Opportunity or Investor's Trap?

Bitcoin's Price Plunge: Opportunity or Crypto Winter Warning?

The cryptocurrency market is once again experiencing turbulence, with Bitcoin taking a significant hit, dropping a substantial 25% from its recent peak. This dramatic downturn has investors and crypto enthusiasts asking the critical question: Is this a temporary setback or the harbinger of another prolonged crypto winter?

The recent price correction has sparked intense debate within the digital asset community. Some seasoned investors view this as a potential buying opportunity, seeing the dip as a chance to accumulate Bitcoin at a more attractive price point. Others are more cautious, warning that this could be the early signs of a more extended market downturn.

Market analysts are closely monitoring key technical indicators and global economic factors that might influence Bitcoin's trajectory. The volatility underscores the inherent unpredictability of cryptocurrency investments, reminding investors of the importance of strategic decision-making and risk management.

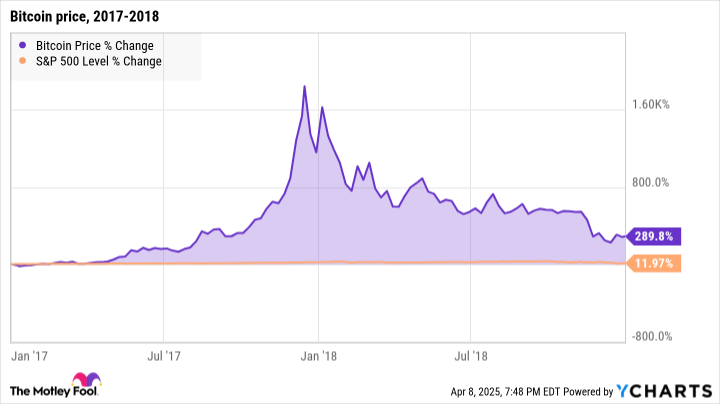

While the current landscape may seem uncertain, historical patterns suggest that Bitcoin has demonstrated remarkable resilience. Previous market corrections have often been followed by periods of significant growth, giving hope to long-term believers in the digital currency.

Investors are advised to conduct thorough research, diversify their portfolios, and approach the market with a balanced perspective. Whether this is a buying opportunity or the beginning of a challenging period remains to be seen.