Budget Balancing Act: Hochul's Strategic Reserves Unleash Dual-Pronged Economic Boost

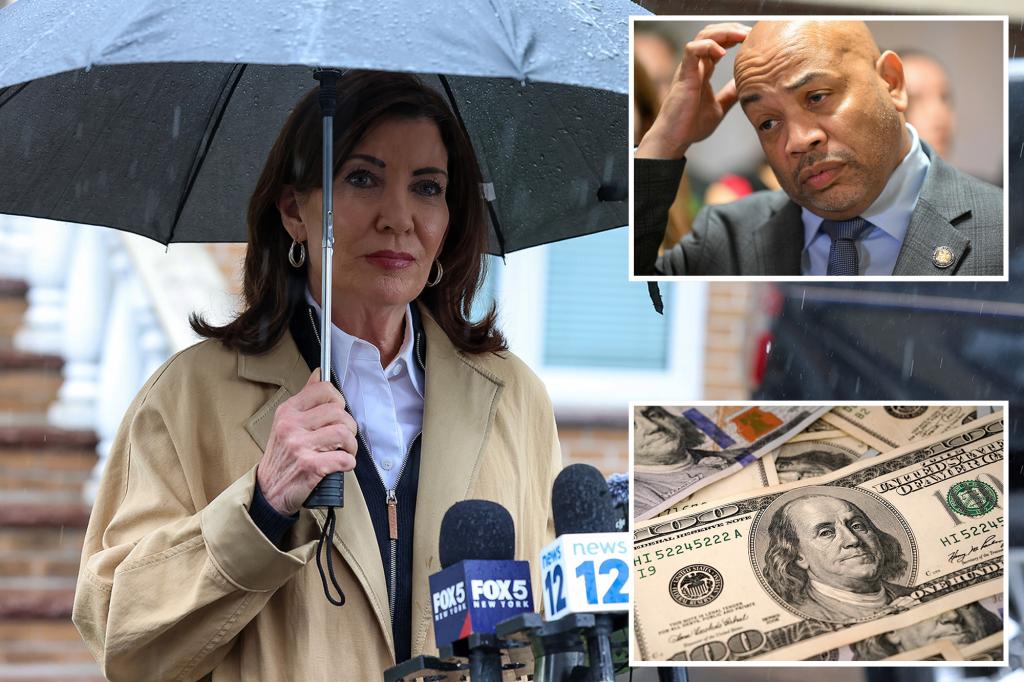

In a controversial move that's sparking heated debate, Governor Kathy Hochul is poised to deliver a significant victory to businesses struggling with massive unemployment-insurance debt. While the decision appears to be a lifeline for struggling companies, critics argue that the funding comes at a questionable cost—essentially redirecting state resources to cover corporate financial burdens.

The governor's plan effectively addresses long-standing pressures from the business community, offering relief from billions in accumulated unemployment insurance obligations. However, the funding mechanism has raised eyebrows, as Hochul seems prepared to tap into state funds to resolve what many see as a complex financial challenge.

Business leaders are likely to celebrate this intervention, viewing it as a crucial support mechanism during ongoing economic uncertainties. Yet, the underlying strategy of using state resources to offset corporate debt remains a contentious issue that could have broader implications for New York's fiscal landscape.

As the details of this financial maneuver continue to unfold, stakeholders from various sectors are closely watching how this unprecedented approach might reshape the state's economic support strategies and potentially set new precedents for future business-government financial interactions.