Corporate Pulse: CEOs Signal Economic Storm Brewing, BlackRock's Fink Reveals

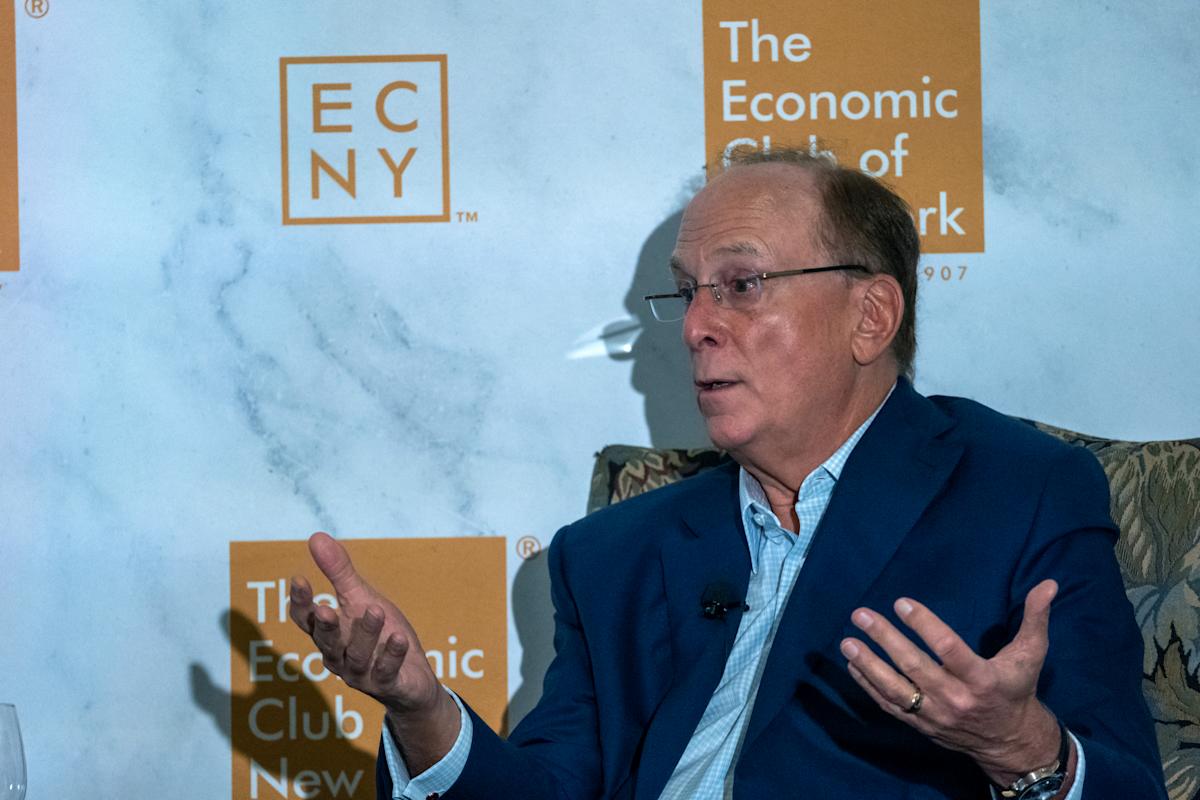

In a stark warning that sent ripples through financial markets, the chief executive of BlackRock, the world's largest investment management firm, painted a sobering picture of the current economic landscape. The top executive suggested that stock markets could potentially plummet an additional 20% from current levels, reflecting growing concerns about economic stability.

Drawing from direct conversations with corporate leaders across various industries, the BlackRock boss revealed a consensus among executives that the United States may already be experiencing a recession. His candid assessment highlights the mounting economic challenges facing businesses and investors in the current volatile market environment.

The comments underscore the increasing uncertainty and potential downside risks that investors and companies are navigating, signaling a potentially turbulent period ahead for financial markets and the broader economy.