Crypto Chaos: How Dogecoin's Popularity Fuels a New Wave of Digital Deception

A Case of Mistaken Identity: How Cryptocurrency Confusion Fuels Scammer Tactics

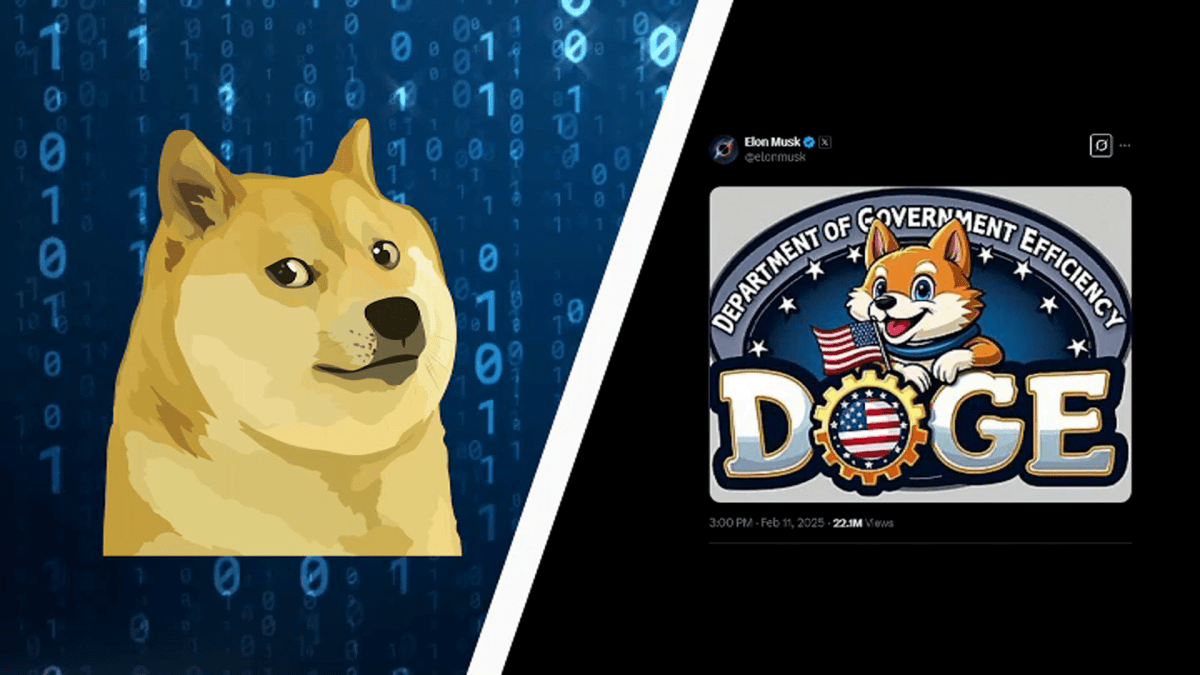

In a clever twist of digital deception, cybercriminals are exploiting the similar acronym between Dogecoin, the popular meme-inspired cryptocurrency, and the Department of Government Efficiency (DOGE), creating a perfect storm for potential fraud.

Unsuspecting victims are falling prey to sophisticated scams that leverage the confusion between these two distinct entities. Scammers are strategically using the shared acronym to create elaborate schemes that trick people into believing they are dealing with an official government department.

The similarity in names provides a thin veneer of legitimacy that allows fraudsters to craft convincing narratives. By blurring the lines between the cryptocurrency and the government department, these criminals are able to manipulate potential targets more effectively.

Experts warn that individuals should exercise extreme caution when encountering communications that reference "DOGE," carefully verifying the source and context before taking any action or sharing personal information.

As digital fraud continues to evolve, this case highlights the importance of vigilance and critical thinking in an increasingly complex online landscape.