Crypto Crackdown: California Exposes 42 Fraudulent Websites Swindling Millions from Unsuspecting Investors

In a bold move to protect consumers, the California Department of Justice has exposed a massive cryptocurrency website fraud scheme. Last year, state authorities successfully dismantled 42 fraudulent websites that were systematically deceiving unsuspecting investors.

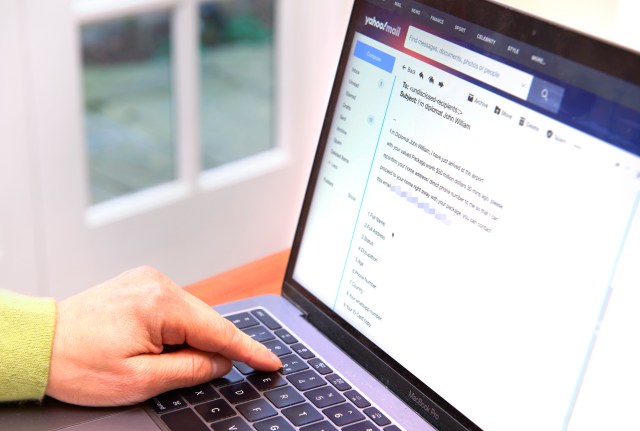

The department's investigation revealed a shocking pattern of financial manipulation, with each victim losing an staggering average of $146,306 to these sophisticated online scams. These fake cryptocurrency platforms were carefully designed to appear legitimate, luring potential investors with promises of high returns and cutting-edge digital investment opportunities.

By shutting down these deceptive websites, the California Department of Justice has taken a significant step in safeguarding consumers from increasingly complex online financial fraud. The action serves as a critical warning to potential investors about the importance of due diligence and skepticism when encountering seemingly attractive cryptocurrency investment opportunities.

Experts recommend that individuals thoroughly research any online investment platform, verify its credentials, and remain cautious of promises that seem too good to be true. The department's intervention highlights the ongoing battle against digital financial crimes and the need for continued vigilance in the rapidly evolving world of cryptocurrency.