Crypto Insider: Saylor's Bold Prediction Signals 13,616% Rocket Ride for One Digital Asset

The cryptocurrency landscape has experienced a remarkable transformation since Donald Trump's presidential victory in November, with digital assets witnessing unprecedented growth. The Trump administration has distinguished itself as potentially the most crypto-friendly political leadership in recent history, signaling a significant shift in the regulatory approach to digital currencies.

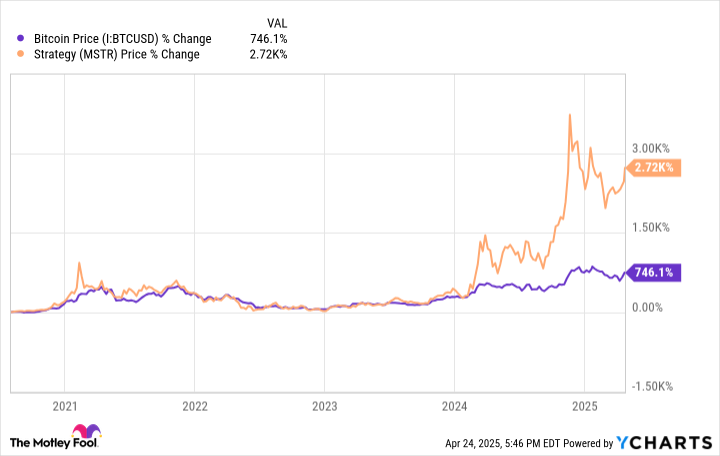

At the forefront of this crypto revolution is Michael Saylor, a visionary entrepreneur who has been championing cryptocurrencies for years. His unwavering enthusiasm and strategic investments have not only inspired confidence among investors but have also helped mainstream the perception of digital assets as a legitimate and promising financial instrument.

The surge in cryptocurrency valuations reflects a growing recognition of blockchain technology's potential and the increasing mainstream acceptance of digital currencies as a viable alternative to traditional financial systems. With supportive political winds and influential advocates like Saylor, the crypto ecosystem continues to evolve and attract both institutional and individual investors.