Crypto Market Chaos: Locked Token Trades Spark Investor Uproar

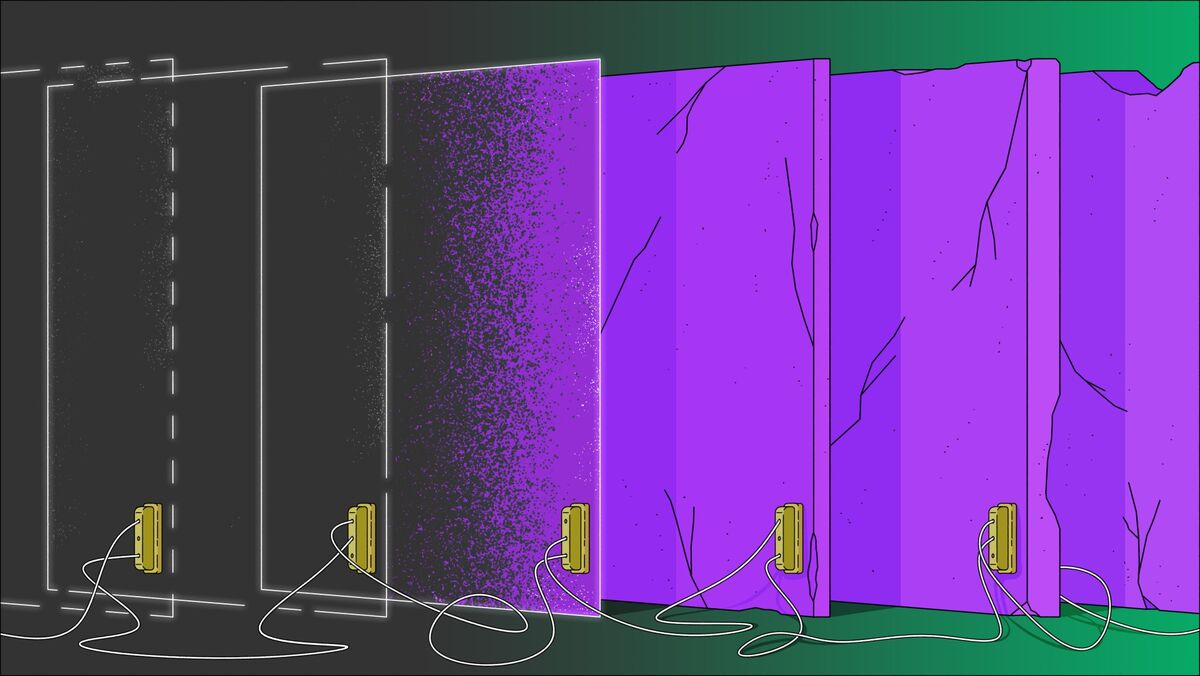

In the dynamic world of cryptocurrency, investors are finding innovative ways to unlock the value of their dormant tokens, sparking both excitement and debate within the digital finance community. Ryan Weeks delves into the emerging trend of monetizing locked-up tokens, revealing a complex landscape of financial creativity and potential controversy.

As traditional token holding strategies evolve, savvy investors are exploring novel approaches to extract value from tokens that would otherwise remain idle. These methods range from sophisticated financial instruments to creative lending platforms that allow token owners to generate returns on assets previously considered illiquid.

The trend is not without its critics, however. While some view these monetization strategies as a breakthrough in crypto finance, others raise concerns about potential market manipulation and the long-term implications for token ecosystems. The debate highlights the ongoing tension between financial innovation and market stability in the rapidly changing world of digital assets.

Investors are increasingly looking beyond simple hodling, seeking ways to maximize the potential of their locked tokens through lending, derivatives, and other sophisticated financial mechanisms. This shift represents a significant evolution in how cryptocurrency assets are perceived and utilized in the broader financial landscape.

As the industry continues to mature, these monetization strategies are likely to become more refined, potentially reshaping how investors approach token ownership and value generation in the digital asset space.