Debt Showdown: Ramsey vs. Kiyosaki - Financial Titans Clash on Money Management

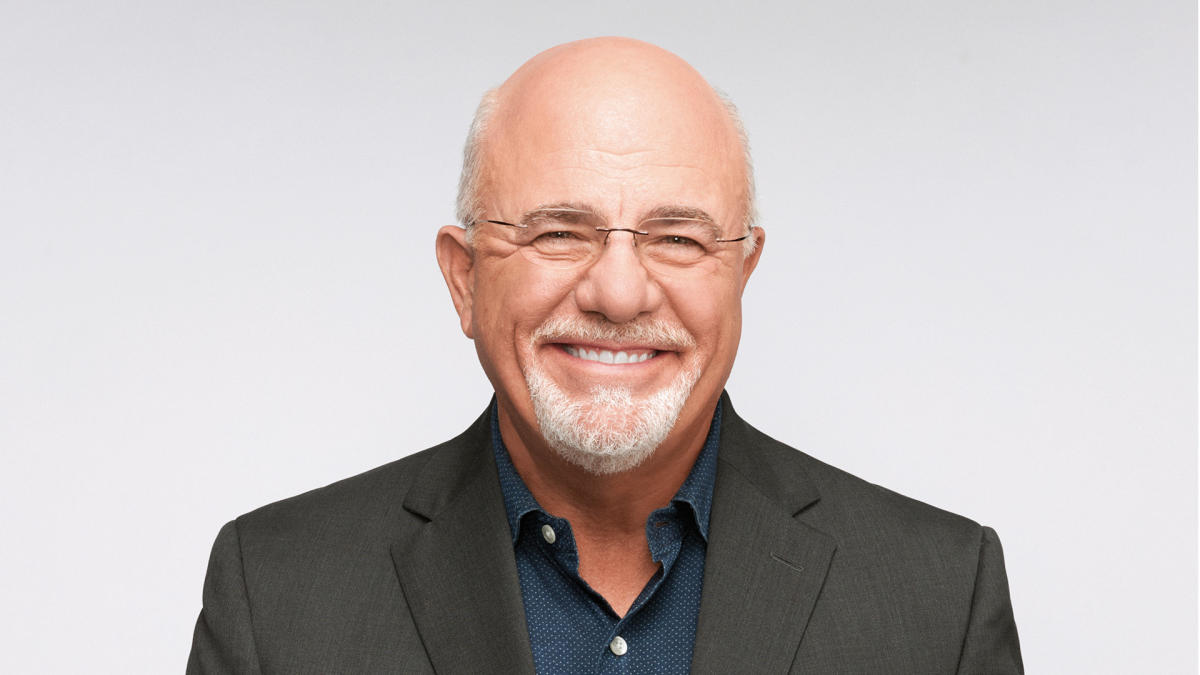

In the world of personal finance, two titans stand out: Dave Ramsey and Robert Kiyosaki. These influential thought leaders have captivated millions with their groundbreaking financial advice and transformative books that challenge traditional money management approaches.

While both experts have distinct philosophies, they share a common mission: empowering individuals to take control of their financial destinies. Ramsey advocates for debt-free living and conservative financial planning, encouraging people to eliminate debt and build robust emergency funds. Kiyosaki, on the other hand, promotes financial education and investing in assets that generate passive income.

Despite their different strategies, Ramsey and Kiyosaki have more in common than meets the eye. Both are passionate about financial literacy, believing that education is the key to breaking free from financial struggles. Their bestselling books have inspired countless readers to rethink their relationship with money and pursue financial independence.

Whether you're drawn to Ramsey's disciplined debt-elimination approach or Kiyosaki's investment-focused mindset, these financial gurus offer valuable insights that can help anyone transform their financial future.