Digital Warfare: FBI Unravels Hamas' Crypto-Funding Network

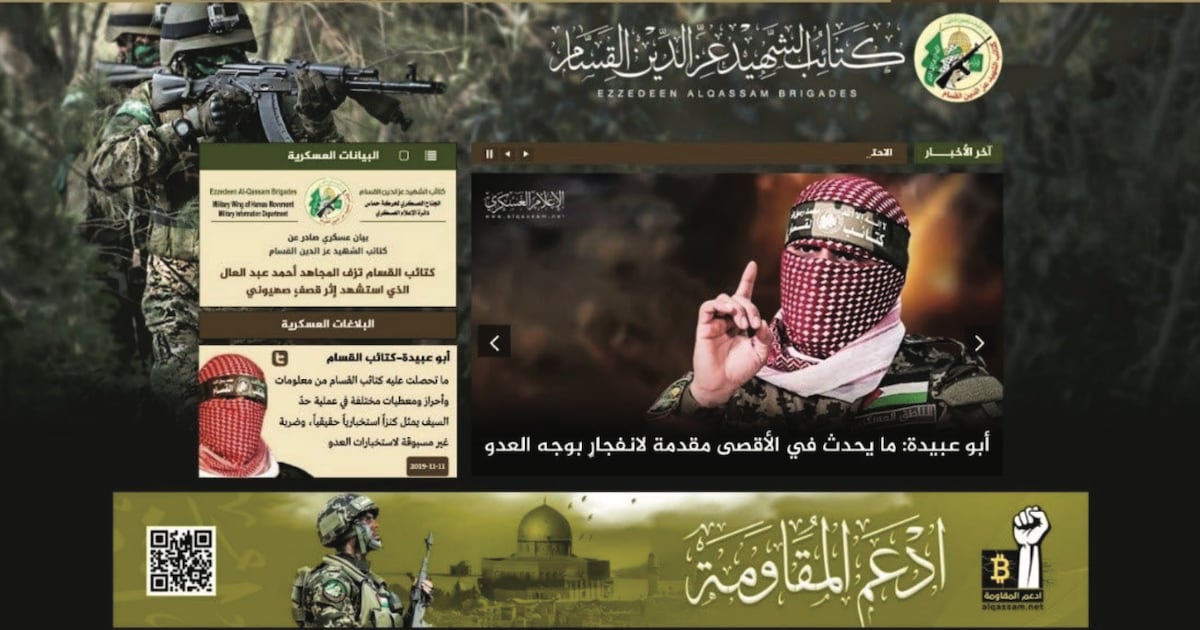

In a significant crackdown on terrorist financing, the US Justice Department has uncovered a complex money laundering operation linked to a militant group. Investigators have meticulously traced financial assets totaling over $1.5 million that were funneled through fundraising addresses controlled by the organization since October of last year.

The sophisticated financial investigation reveals how the militant group has been systematically moving and concealing funds through multiple channels. By identifying and tracking these fundraising addresses, federal authorities have shed light on the group's intricate financial network and its methods of generating and disguising illegal revenue.

This breakthrough not only exposes the financial infrastructure of the militant organization but also demonstrates the Justice Department's commitment to disrupting terrorist financing mechanisms. The comprehensive tracing of these assets represents a critical step in undermining the group's operational capabilities and financial sustainability.

Law enforcement officials continue to investigate the full extent of the group's financial activities, signaling a sustained effort to combat terrorist funding and protect national security.