Economic Alarm: 90% Chance of Tariff Tsunami Triggering Recession, Expert Warns

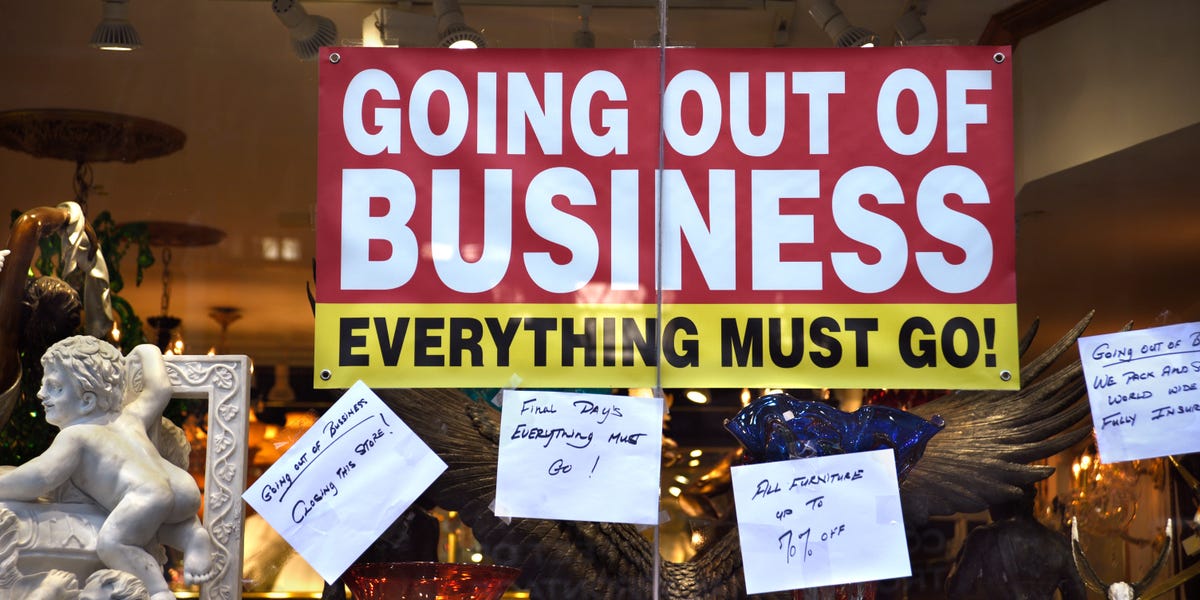

In a stark economic forecast, Apollo's chief economist warns that escalating tariffs could potentially trigger a significant economic downturn. The analysis suggests a potential 4% reduction in GDP, with an alarming 90% probability of what experts are calling a "Voluntary Trade Reset Recession."

The projection highlights the potential ripple effects of trade tensions, painting a sobering picture of the economic landscape. With such a high likelihood of economic disruption, businesses and policymakers are urged to carefully consider the far-reaching implications of current trade strategies.

The forecast serves as a critical wake-up call, underscoring the delicate balance of international trade and the potential consequences of protectionist policies. As global markets continue to navigate uncertain terrain, the predicted economic impact could have profound implications for industries, investors, and consumers alike.