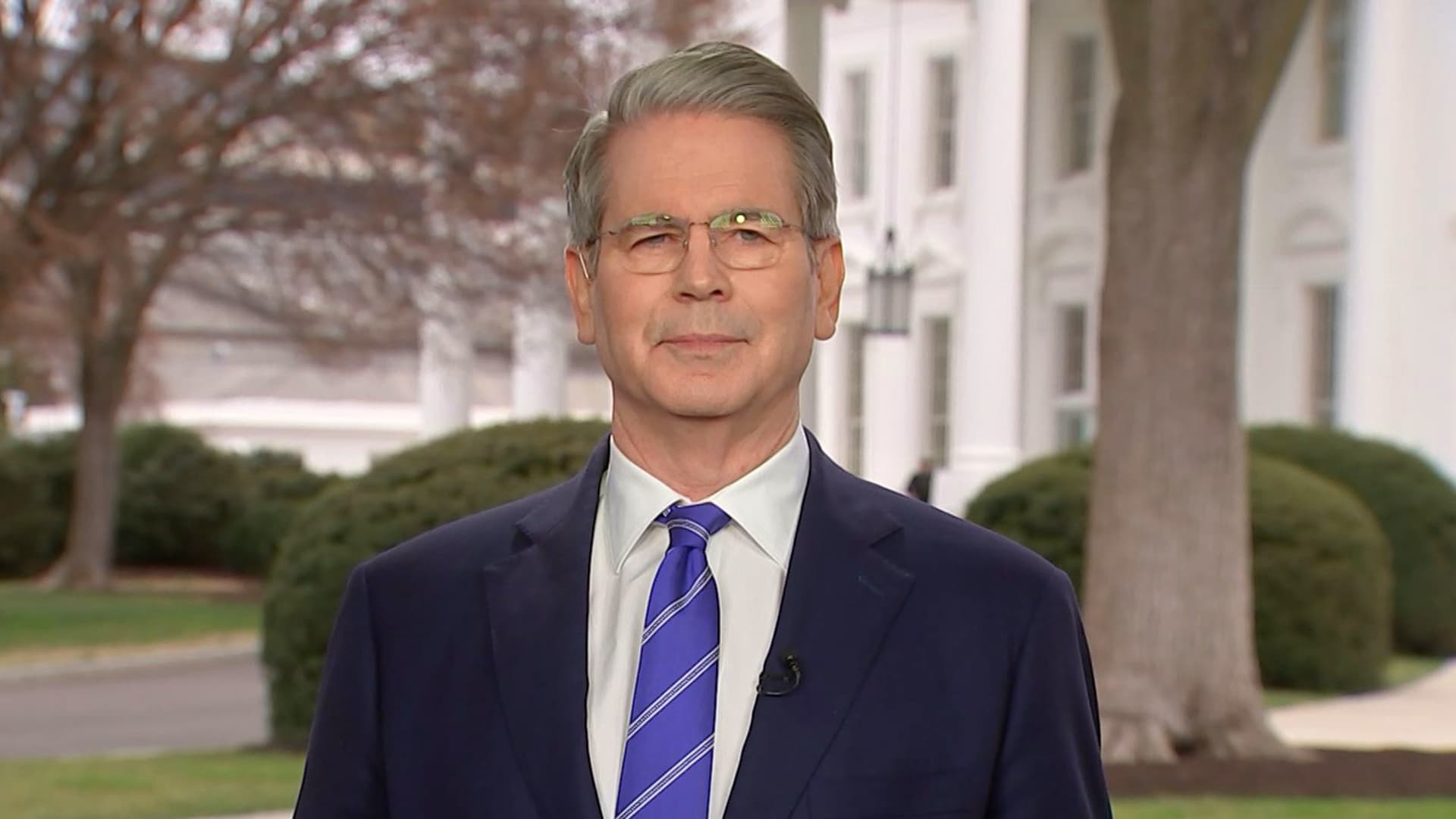

Financial Cliff Averted? Bessent Warns of Looming Economic Showdown at White House

In a confident assessment of the current economic landscape, market expert Bessent offers an optimistic perspective on recent market fluctuations. He argues that the current pullbacks are merely temporary and should not alarm investors. Instead, Bessent sees these market movements as natural cycles that present potential opportunities for strategic investors.

Moreover, Bessent is particularly bullish about the long-term economic outlook, citing the Trump administration's pro-business policies as a key driver of future growth. He believes these policies will create a robust economic environment that will ultimately benefit investors and businesses alike. By fostering a business-friendly climate, these strategies are expected to stimulate economic expansion, encourage innovation, and potentially unlock new avenues of prosperity.

The expert's analysis suggests that patient investors who can look beyond short-term market volatility will be well-positioned to capitalize on the anticipated economic momentum. Bessent's insights provide a reassuring message for those concerned about recent market uncertainties, emphasizing the potential for sustained economic growth and opportunity.