Financial Shock Waves: Why Your Budget Needs a Survival Kit

The Financial Ticking Time Bomb: Understanding and Mitigating Excessive Leverage

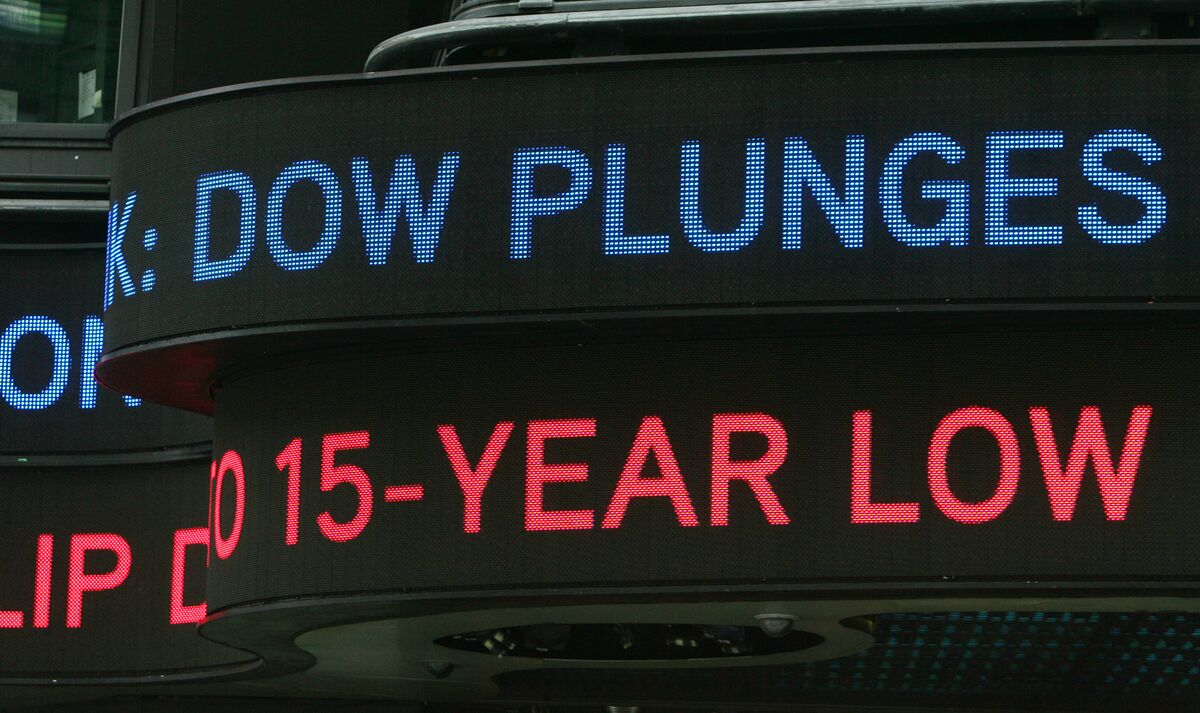

In today's interconnected global economy, excessive leverage has emerged as a silent but potent threat that can destabilize financial markets and impact individuals, businesses, and entire economies. Unlike visible economic challenges, leverage operates like an invisible undercurrent, capable of triggering widespread financial disruption with alarming speed.

Understanding Leverage's Double-Edged Sword

Leverage isn't inherently negative. When used strategically, it can amplify investment potential and drive economic growth. However, when taken to extremes, it transforms from a powerful financial tool into a potential catastrophic risk. The 2008 financial crisis serves as a stark reminder of how unchecked leverage can unravel complex financial systems.

Key Risks of Excessive Leverage

• Amplified Financial Vulnerability

• Increased Systemic Economic Instability

• Reduced Financial Flexibility

• Higher Probability of Cascading Market Failures

Practical Strategies for Mitigation

1. Implement Robust Risk Management

2. Diversify Investment Portfolios

3. Maintain Conservative Debt-to-Income Ratios

4. Regularly Assess and Rebalance Financial Exposures

By adopting a proactive and measured approach, individuals and institutions can protect themselves from the potential devastating consequences of excessive leverage. Knowledge, discipline, and strategic financial planning are the most effective shields against this pervasive economic risk.