Geopolitics Meets Crypto: Trump's Digital Venture Lands Massive UAE Backing

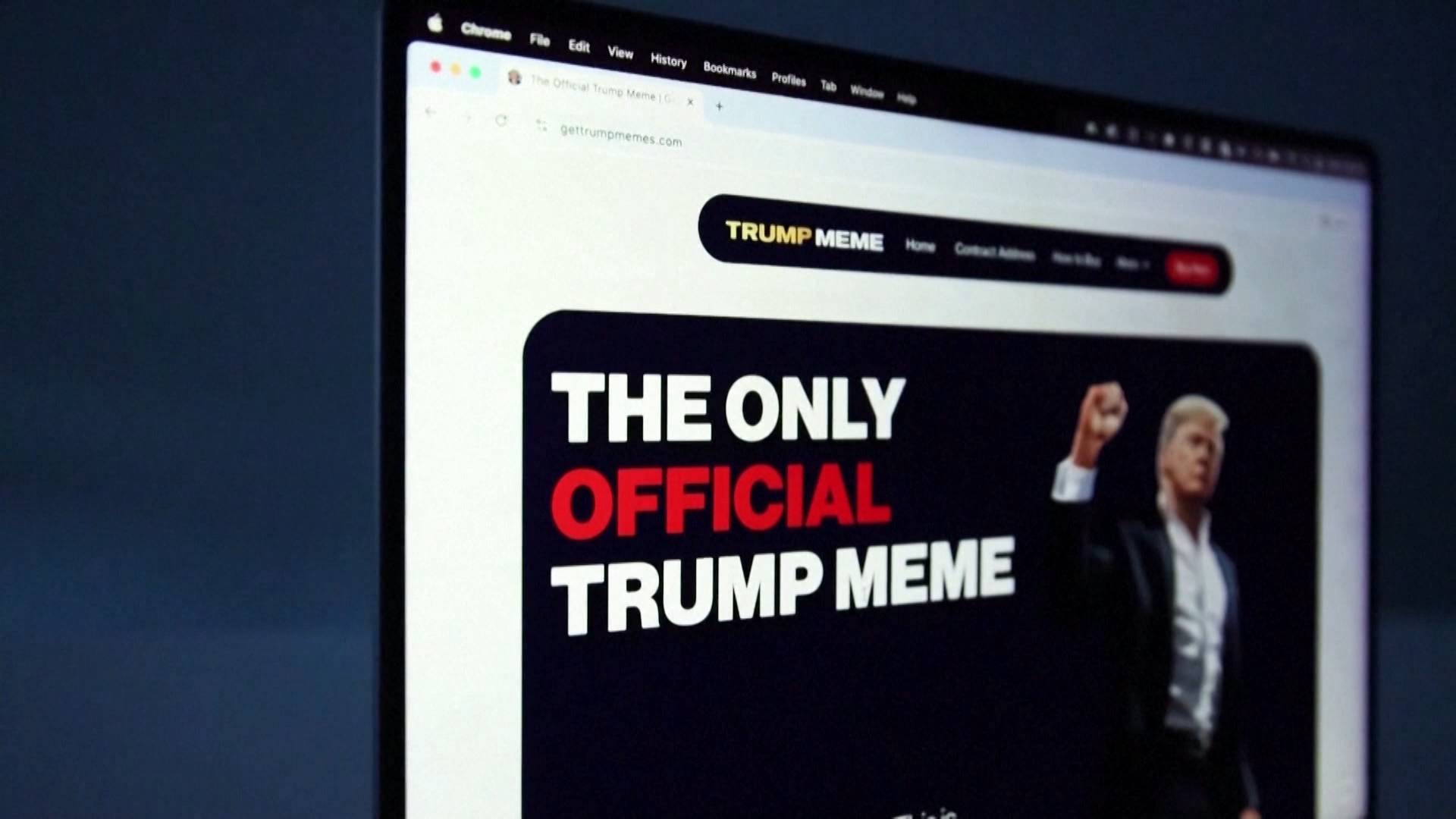

In a groundbreaking financial move, the Trump family's cryptocurrency venture has announced a massive $2 billion investment from an Abu Dhabi-backed fund into the global crypto exchange Binance. The deal, which will utilize a Trump-branded cryptocurrency, could potentially generate hundreds of millions of dollars for the Trump family.

The unprecedented transaction has raised significant ethical concerns, with Robert Weissman, co-president of Public Citizen, delivering a scathing critique. "This goes far beyond a mere conflict of interest," Weissman stated. "This appears to be a clear-cut case of foreign policy and justice being openly traded for financial gain."

The investment highlights the complex intersection of international finance, political influence, and cryptocurrency markets, drawing sharp scrutiny from ethics watchdogs and political observers. The substantial foreign government investment in a venture directly linked to a former U.S. president represents an extraordinary and potentially controversial financial arrangement.

As the details of the deal continue to emerge, questions about transparency, potential conflicts of interest, and the broader implications for international financial relationships are likely to intensify.