Global Markets on Edge: Trade Tensions Spark Financial Storm

As U.S. tariff policies continue to expand their reach, with a new wave of trade restrictions poised to take effect on April 2, economic experts are growing increasingly concerned about the potential financial ripple effects. The escalating trade tensions are casting a shadow over the economic landscape, signaling potential challenges that could disrupt market stability and international commerce.

The upcoming tariff implementation represents more than just a simple trade adjustment; it's a complex maneuver that could significantly impact global economic dynamics. Financial analysts are closely monitoring the situation, recognizing that these trade barriers might trigger a cascade of economic consequences that extend far beyond immediate border transactions.

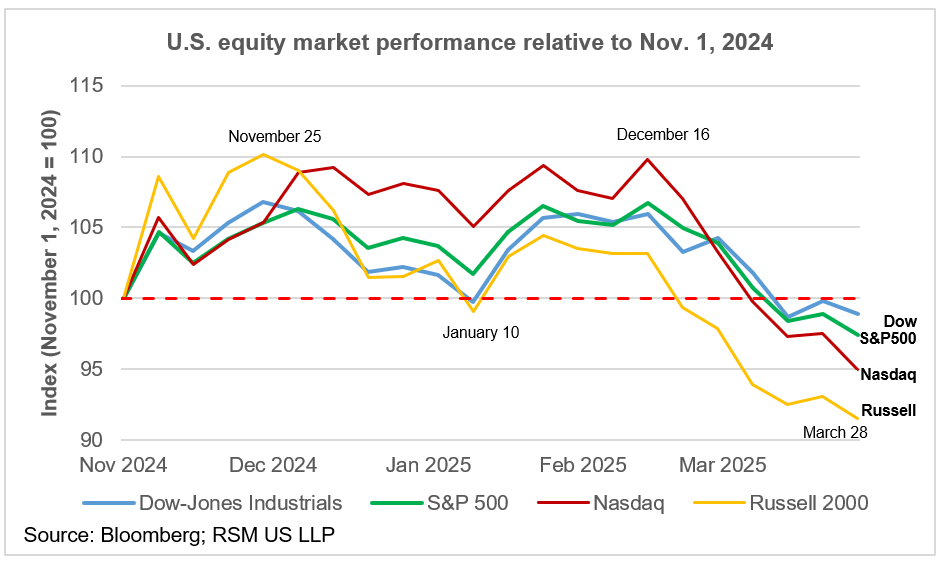

With each new round of tariffs, the risks to economic predictability and financial market performance become more pronounced. Investors, businesses, and policymakers are now navigating an increasingly uncertain terrain, where traditional economic forecasting models are being tested by the unpredictable nature of international trade negotiations.