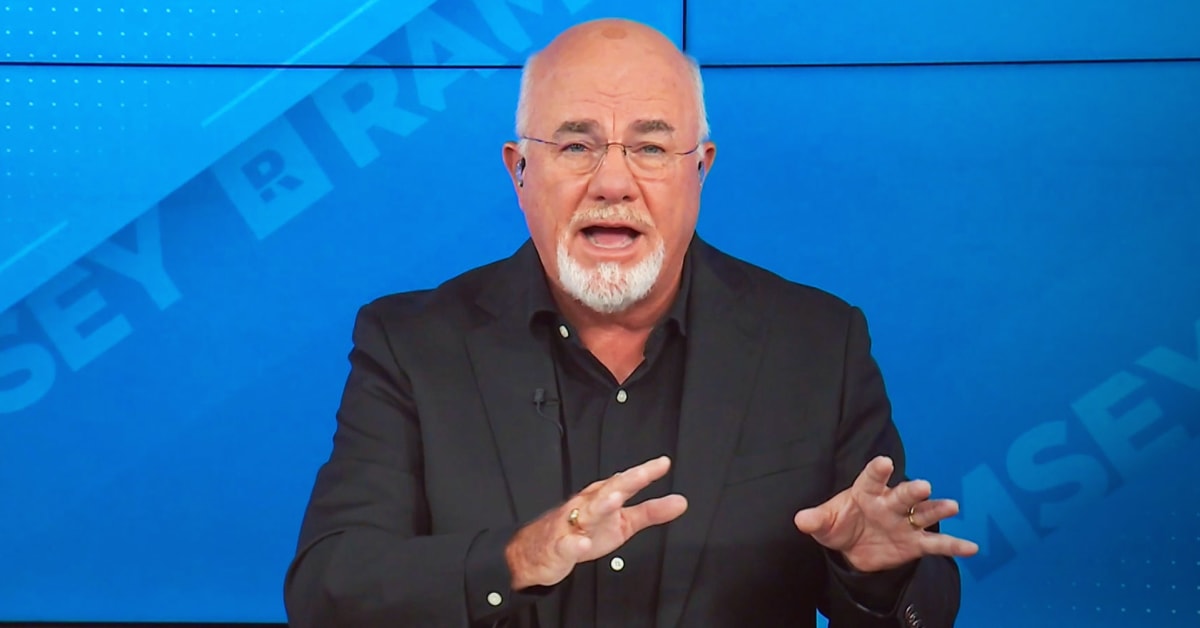

Homebuying Pitfall: Dave Ramsey Reveals the Critical Error Draining Your Wallet

Navigating the Home Buying Journey: A Financial Perspective

Purchasing a home is far more than just finding your dream living space—it's a complex financial decision with long-lasting implications. As a best-selling personal finance expert, I've witnessed countless individuals underestimate the profound economic impact of homeownership.

When you decide to buy a home, you're not simply acquiring property; you're making a significant investment that can dramatically shape your financial future. From mortgage rates and property taxes to maintenance costs and potential appreciation, each aspect carries substantial weight in your overall financial landscape.

Smart homebuyers understand that this decision extends beyond the initial purchase price. They consider factors like location, market trends, potential equity growth, and the total cost of ownership. It's not just about monthly mortgage payments, but about creating a strategic financial asset that can potentially build wealth over time.

Moreover, the financial ramifications of home ownership ripple through multiple aspects of your personal economic ecosystem. Your credit score, long-term savings potential, tax deductions, and investment portfolio can all be influenced by this pivotal decision.

Before taking the plunge, carefully evaluate your financial readiness, understand the market dynamics, and develop a comprehensive strategy that aligns with your personal and financial goals.