Nasdaq Dip: 3 Genius Stocks to Supercharge Your $1,000 Investment

Navigating Market Corrections: Smart Investment Strategies with Tech Giants

When markets experience turbulence, savvy investors see opportunity. The recent correction in the tech-heavy Nasdaq Composite has created an intriguing landscape for strategic investors with some disposable capital.

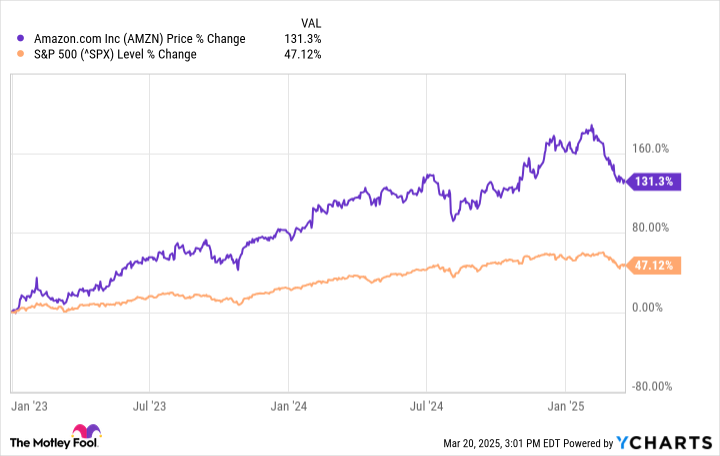

If you have $1,000 available—money that isn't earmarked for essential expenses or emergency funds—two standout tech companies present compelling investment possibilities: Amazon (NASDAQ: AMZN) and Alphabet (NASDAQ: GOOG/GOOGL).

These industry-leading tech giants offer robust potential for investors looking to capitalize on market fluctuations. Their strong fundamentals, innovative business models, and proven track records make them attractive options for those seeking to build long-term wealth during market corrections.

By carefully evaluating these opportunities and understanding market dynamics, investors can transform potential market volatility into a strategic advantage.