Plastic Chains: How Credit Card Debt is Derailing Retirement Dreams

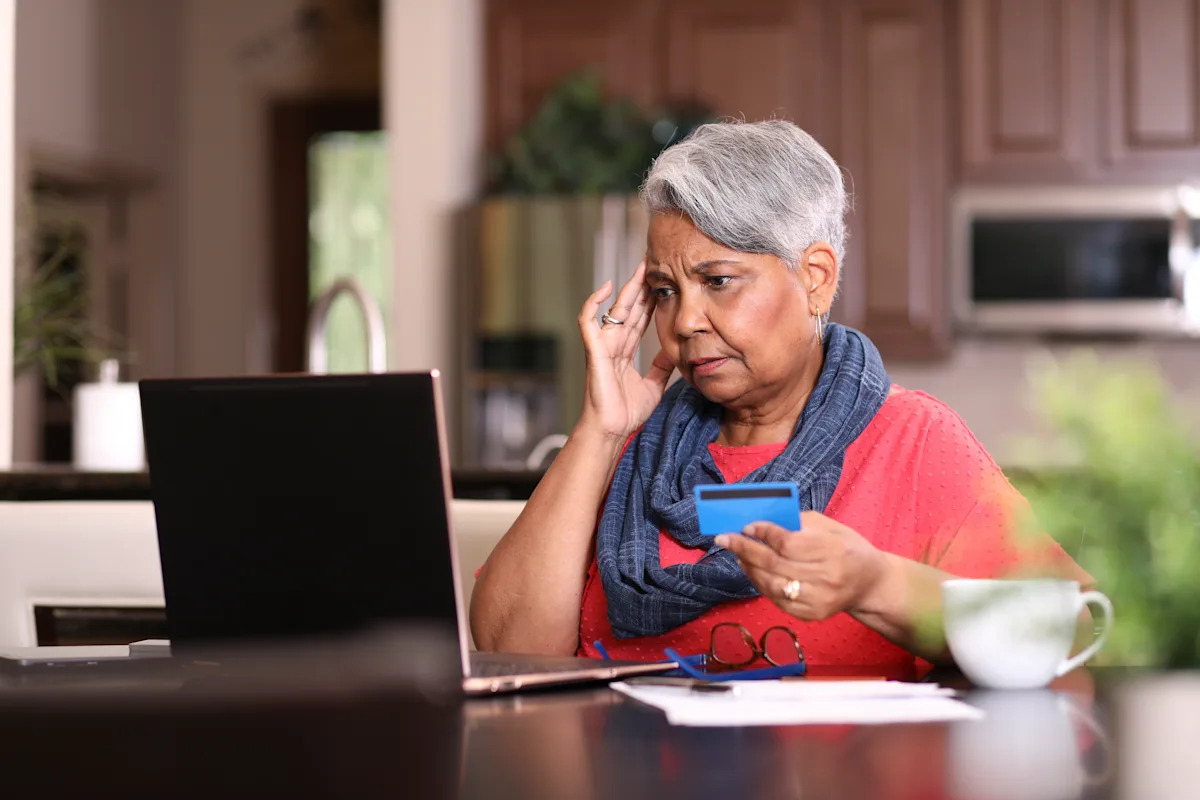

Navigating Financial Challenges: Credit Card Debt in Retirement Years

As retirement approaches, many Americans find themselves wrestling with an unexpected financial burden: credit card debt. For adults aged 50 and older, the struggle is increasingly common, with a growing number of seniors relying on credit cards to manage daily living expenses.

The golden years, once imagined as a time of financial freedom, are now complicated by mounting credit card balances. Many retirees and near-retirees are caught in a challenging cycle of using credit to bridge financial gaps, creating a precarious economic situation that can quickly erode retirement savings.

This trend highlights a critical need for financial planning, debt management strategies, and increased awareness about the potential long-term impacts of credit card debt during retirement. As living costs rise and fixed incomes remain tight, seniors must be proactive in addressing their financial health and exploring ways to reduce credit card dependency.