Prison Whistleblower Wins: State Finance Council Agrees to $4,000 Settlement

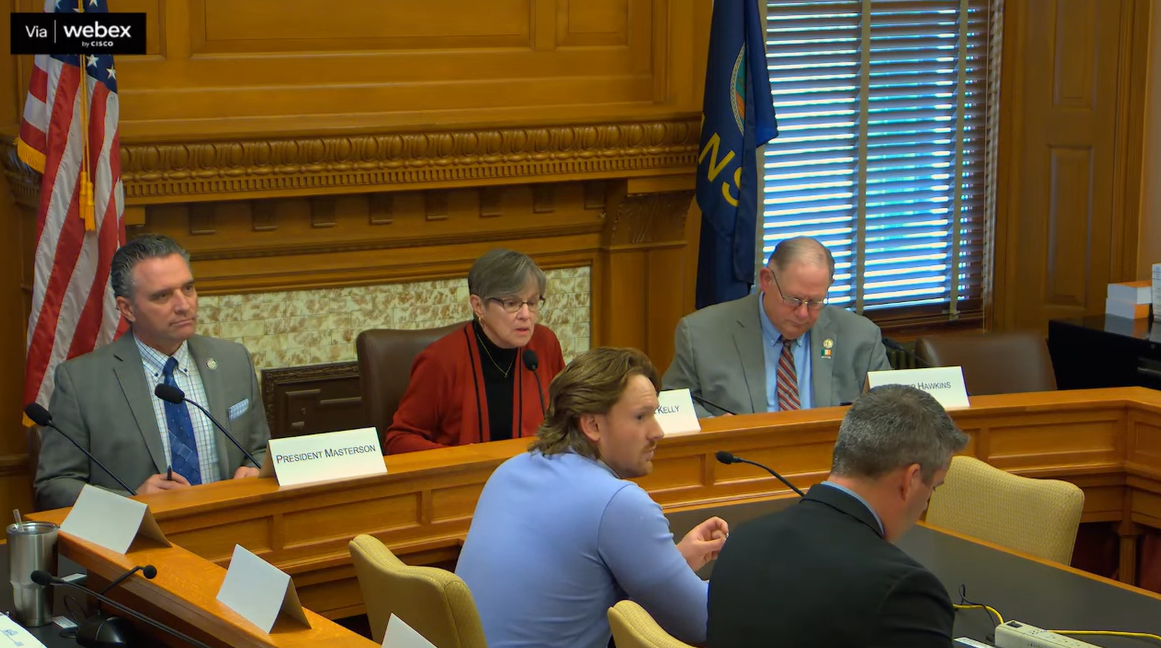

In a recent meeting, the State Finance Council approved a settlement of $4,000 for a prison inmate lawsuit, demonstrating the state's commitment to resolving legal disputes efficiently. Additionally, the council made a strategic decision to sell two properties previously owned by the Kansas State Fair that were deemed surplus assets.

The property sale netted $137,000, providing a welcome financial boost to state resources. By divesting these surplus properties, the council showcases its prudent approach to managing state-owned real estate and maximizing potential revenue streams.

The dual actions—settling the lawsuit and selling surplus properties—reflect the Finance Council's careful financial management and commitment to responsible governance. These decisions underscore the ongoing efforts to optimize state resources and address legal obligations in a timely and cost-effective manner.