Safe or Risky? The US Bond Market's Uncertain Future Revealed

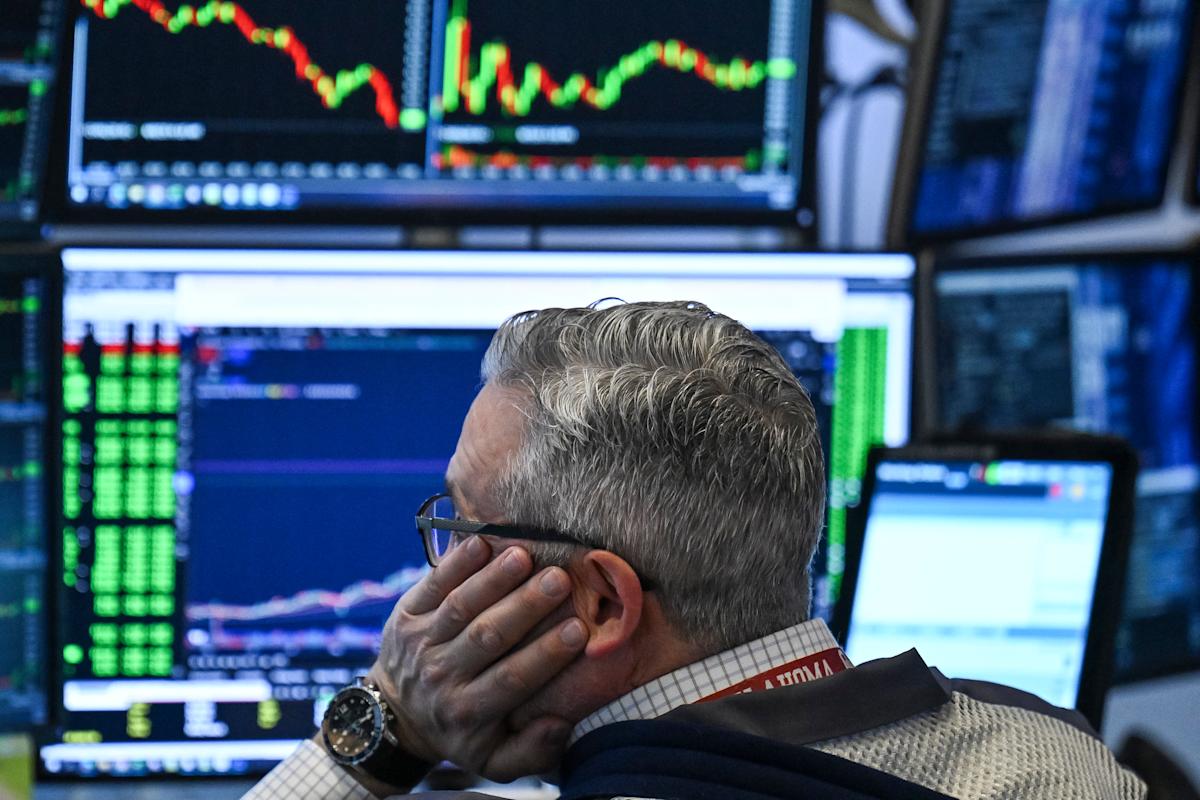

President Donald Trump's recent barrage of tariff declarations has sent shockwaves through financial markets, creating uncertainty among both stock market investors and government bond traders. The rapid-fire trade policy announcements have triggered widespread market volatility, leaving investors on edge and scrambling to reassess their investment strategies.

Trump's unpredictable approach to international trade has become a significant source of market anxiety, with each new tariff announcement potentially reshaping economic landscapes and challenging established market expectations. Investors are closely monitoring these developments, recognizing that the potential economic implications could be far-reaching and complex.

The sudden shifts in trade policy have not only impacted stock market performance but have also created ripple effects across government bond markets. Traders and financial analysts are working overtime to interpret the potential long-term consequences of these aggressive trade maneuvers, highlighting the delicate balance of global economic relationships in an increasingly interconnected world.