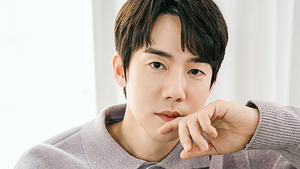

Tax Bombshell: Actor Yoo Yeon-seok Faces Massive Financial Probe

Korean entertainment star Yoo Yeon-seok finds himself at the center of a high-profile tax controversy, joining a growing list of celebrities under scrutiny for potential tax minimization strategies. The beloved actor, known for his memorable roles in hit K-dramas like Hospital Playlist and Reply 1994, is now facing an unprecedented tax bill of approximately 7 billion won (equivalent to $4.8 million).

This staggering amount is reportedly the largest tax assessment ever imposed on a South Korean celebrity, drawing significant media attention and public discussion. The case highlights an ongoing trend in the entertainment industry where celebrities are increasingly being examined for their complex financial arrangements and potential tax optimization methods.

Yoo's agency, KingKong by Star, has been thrust into the spotlight as investigations continue, with mounting criticism and allegations of potential tax evasion swirling around the high-profile actor. The situation underscores the increasing regulatory scrutiny of personal corporations and financial strategies used by public figures to manage their substantial earnings.

As the investigation unfolds, the case serves as a stark reminder of the complex intersection between celebrity finances, tax regulations, and public accountability in South Korea's entertainment landscape.