Teen Investor Breaks Ground: High School Student Pens Financial Guide for Young Entrepreneurs

Financial literacy isn't just for adults—it's a critical life skill that teenagers can and should master early. Just ask Isha Patel, a dynamic 16-year-old junior at James B. Conant High School who is challenging traditional views on youth financial education.

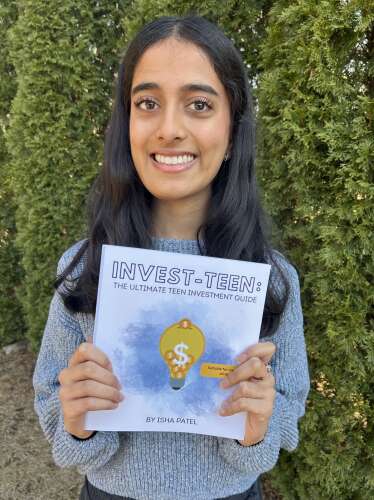

With passion and purpose, Patel has emerged as a young advocate for financial empowerment, authoring "Invest-Teen: The Ultimate Guide" to help her peers understand the complexities of money management. Her mission goes beyond textbook learning; she believes that understanding finances is a fundamental tool for future success.

At an age when most teenagers are focused on social media and extracurricular activities, Patel is breaking ground by demystifying investment strategies, budgeting techniques, and financial planning for her generation. Her book isn't just another academic exercise—it's a practical roadmap designed to equip young people with the knowledge traditional schools often overlook.

By transforming financial education from a daunting topic to an accessible and exciting journey, Patel is inspiring her peers to take control of their financial futures. Her work demonstrates that with the right guidance and resources, teenagers can become financially savvy and confident decision-makers.