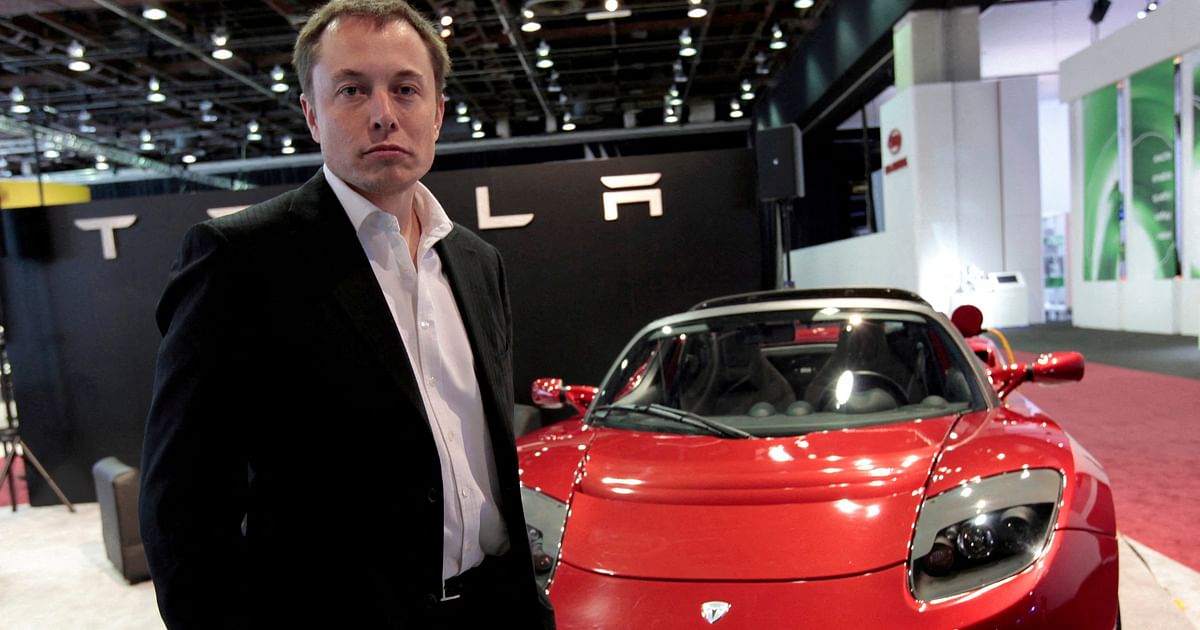

Tesla Insider Sell-Off: Musk Family and Executives Cash Out, Raising Eyebrows on Wall Street

Recent stock sales by Tesla's board members, including a significant $27 million liquidation by Elon Musk's brother Kimball Musk, have sparked widespread speculation about the electric vehicle manufacturer's financial stability. The substantial share disposal has caught the attention of investors and market analysts, who are closely examining the potential implications of these high-profile insider transactions.

Kimball Musk's substantial stock sale comes at a time of increased scrutiny for Tesla, raising eyebrows about the company's internal confidence and future prospects. While insider stock sales are not uncommon in the corporate world, the scale and timing of these transactions have prompted investors to question the underlying motivations and potential financial challenges facing the innovative automotive company.

The move has triggered a broader conversation about Tesla's current market position, ongoing challenges in the electric vehicle sector, and the potential signals being sent by board members through their stock trading activities. Investors and market watchers are now keenly observing how these developments might impact Tesla's stock performance and overall market perception in the coming weeks.