Tesla's Earnings Shock: Investor Ross Gerber Sounds Alarm on Electric Vehicle Giant's Troubling Performance

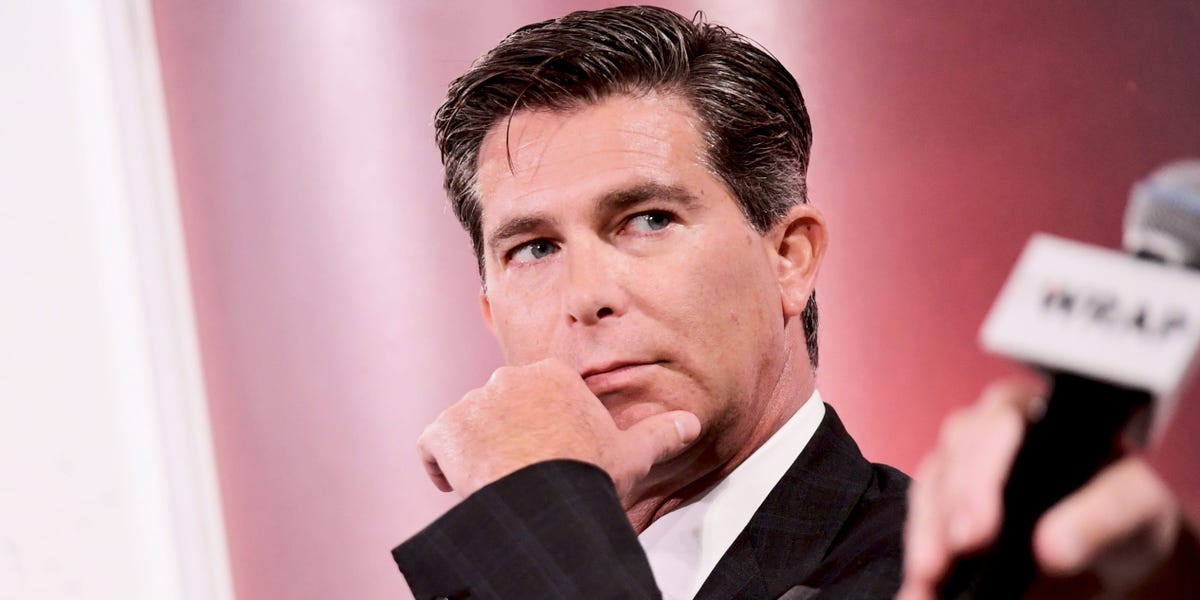

In a candid assessment of Tesla's current landscape, early investor Gary Gerber suggests that the damage to the company's brand may already be irreparable, regardless of Elon Musk's potential return. Gerber's insights highlight the deep-seated challenges facing the electric vehicle manufacturer in the wake of recent controversies and leadership turbulence.

Speaking exclusively to Business Insider, Gerber emphasized that the impact of recent events has potentially created lasting repercussions for Tesla's reputation. His comments underscore a growing sentiment among investors that the company's brand integrity has been significantly compromised, with or without Musk's direct involvement.

The statement reflects the complex dynamics surrounding Tesla's leadership and public perception, suggesting that the company may need more than just a leadership change to restore its former glory. Gerber's perspective offers a sobering view of the potential long-term consequences of recent high-profile challenges facing the electric vehicle pioneer.