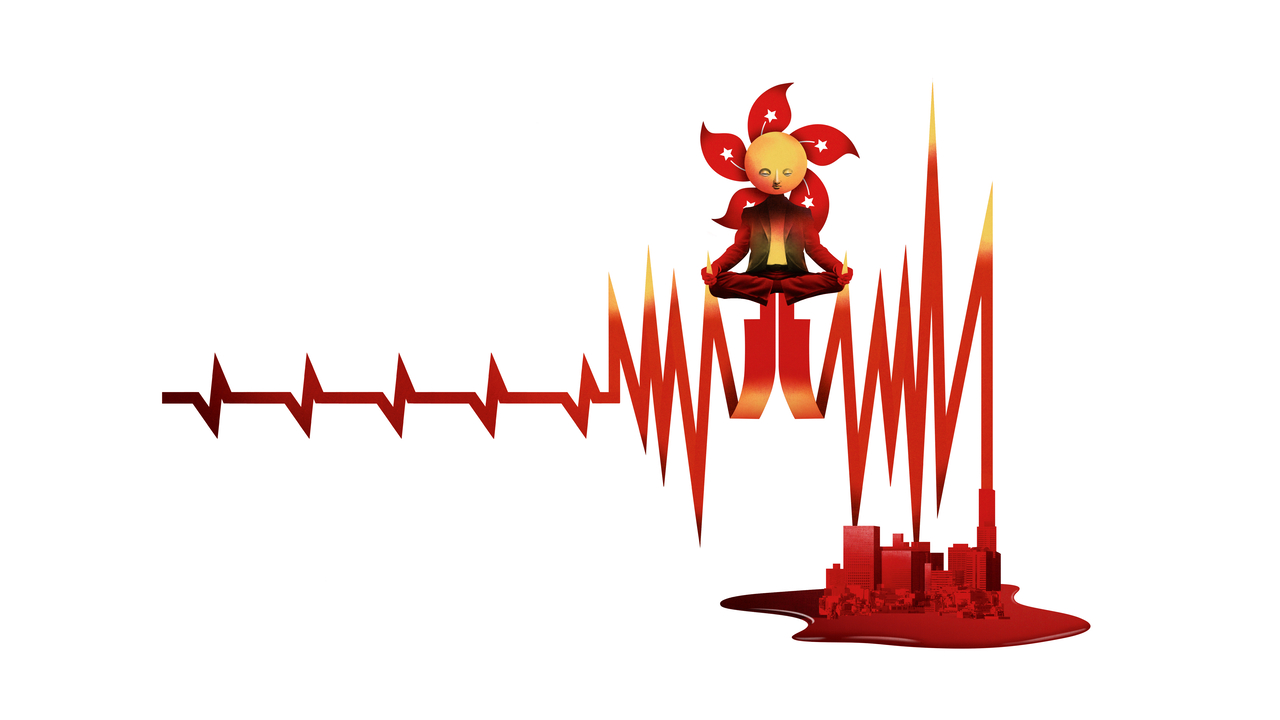

Trade Tremors: Asian Markets Brace for Trump's Tariff Tsunami

In the dynamic world of financial markets, perception often diverges sharply from reality. Contrary to the sensationalized narratives pushed by media and market analysts, the economic landscape is far more nuanced and resilient than many would have you believe.

Investors and consumers alike are bombarded with apocalyptic predictions and doom-and-gloom forecasts that paint a picture of imminent economic collapse. However, a closer examination reveals a more balanced and optimistic perspective. Markets have an inherent ability to adapt, innovate, and overcome challenges that seem insurmountable at first glance.

The key is to look beyond the headlines and understand the fundamental strengths of our economic ecosystem. Businesses continue to innovate, entrepreneurs are finding creative solutions to complex problems, and global markets demonstrate remarkable flexibility in the face of unprecedented challenges.

While it's crucial to remain informed and realistic, it's equally important to avoid falling prey to excessive negativity. Economic cycles are natural, and what may seem like a significant setback is often just a temporary fluctuation in a broader, more promising trajectory.

Smart investors and forward-thinking individuals recognize that opportunity exists even in seemingly challenging times. By maintaining a balanced perspective, staying informed, and remaining adaptable, we can navigate economic uncertainties with confidence and strategic insight.