Trade Wars Beware: Buffett Warns Against Economic Weaponization at Berkshire Powwow

The Legendary Berkshire Hathaway Annual Shareholder Meeting: A Gathering of Investment Wisdom

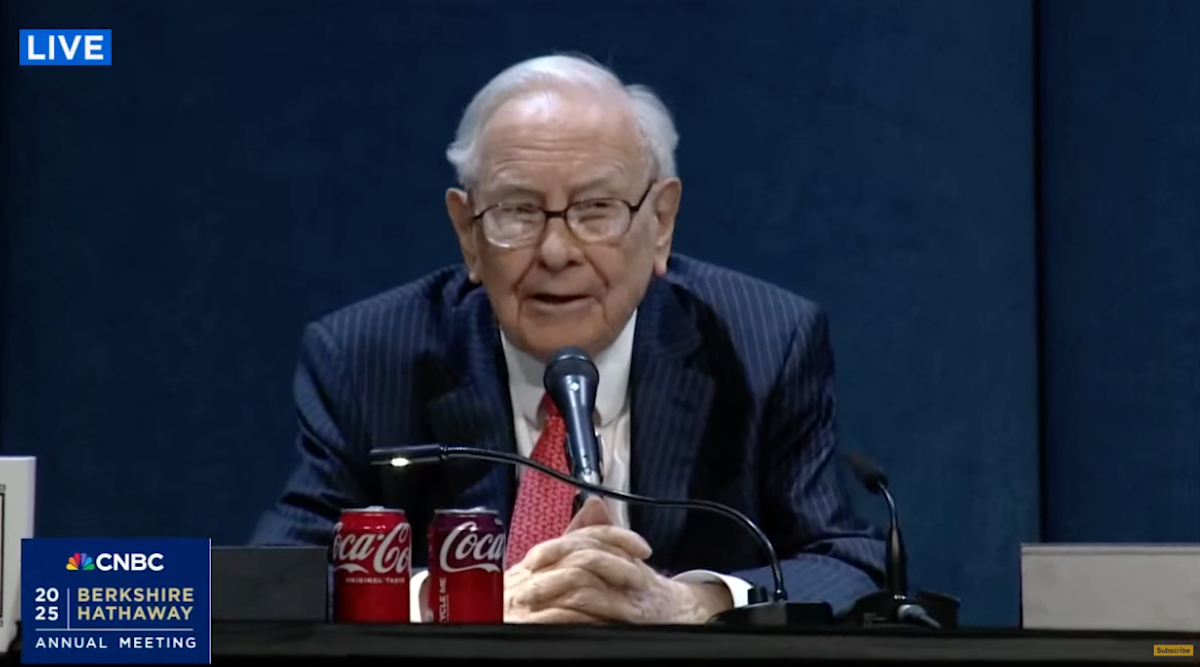

Investors and business enthusiasts from around the world are eagerly anticipating the most anticipated financial event of the year - the annual Berkshire Hathaway shareholder meeting. Led by the iconic Warren Buffett, this extraordinary gathering is more than just a corporate meeting; it's a masterclass in investment strategy and business insight.

Known affectionately as the "Woodstock of Capitalism," this annual event draws thousands of shareholders and market watchers to Omaha, Nebraska. Warren Buffett and his business partner Charlie Munger will once again take center stage, offering their unparalleled perspectives on investing, business trends, and economic landscapes.

Shareholders holding both Class A (BRK-A) and Class B (BRK-B) stocks will have the unique opportunity to gain direct insights from two of the most successful investors in history. The meeting promises to be a blend of financial wisdom, candid discussions, and strategic revelations that have made Berkshire Hathaway a legendary investment powerhouse.