AI Titan Nvidia Rebounds: GTC Conference Sparks Investor Confidence in Tech's Trillion-Dollar Future

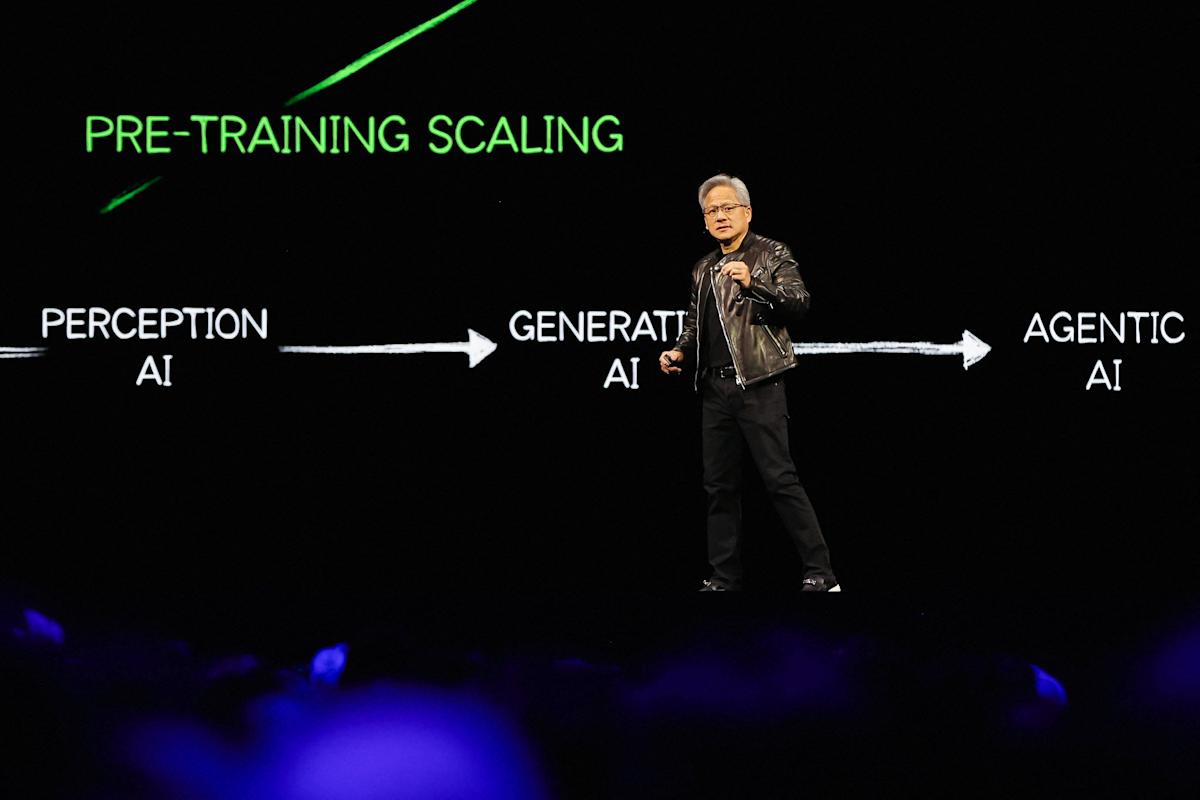

Nvidia's stock staged a surprising comeback after experiencing a two-day decline that wiped out 5% of its market value. The company's annual GTC (GPU Technology Conference) failed to generate the expected investor enthusiasm, coinciding with a broader market pullback.

Despite the initial market skepticism, Nvidia demonstrated its resilience in the volatile tech landscape. The conference, which typically showcases the company's cutting-edge AI and graphics technologies, seemed to fall short of investors' heightened expectations this year.

The stock's reversal highlights the ongoing volatility in the tech sector, particularly for AI-focused companies like Nvidia. While the conference may not have immediately impressed Wall Street, the company continues to be a key player in the rapidly evolving artificial intelligence and graphics processing market.

Investors and market watchers remain closely attuned to Nvidia's strategic moves, recognizing the company's critical role in powering AI innovations across multiple industries.