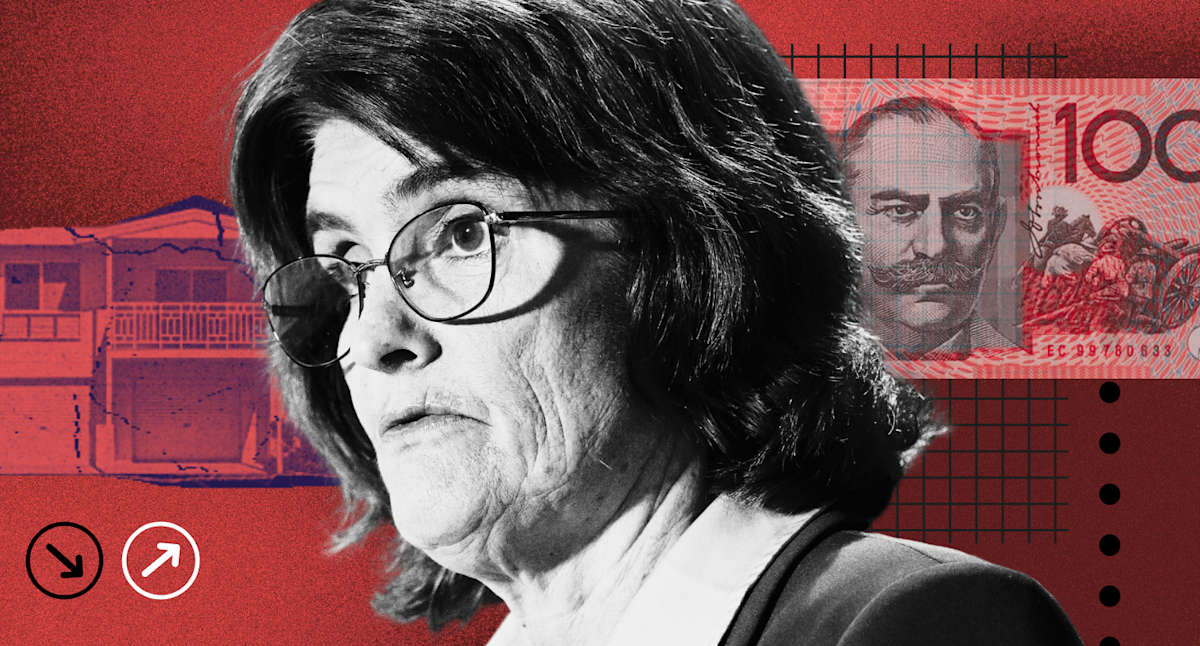

Economic Pressure Cooker: RBA Faces Critical Moment to Slash Rates Amid 'Extreme' Market Turmoil

In these turbulent economic times, the Reserve Bank stands at a critical crossroads with the power to intervene and stabilize financial markets. As stock markets plummet and investor confidence wavers, the central bank's ability to swiftly convene its board and decisively cut interest rates could be the lifeline our economy desperately needs.

The current market volatility demands immediate and strategic action. With the financial landscape showing signs of significant stress, the Reserve Bank's unique authority to rapidly assemble its board and implement emergency monetary policy measures becomes not just an option, but a necessity. By potentially lowering interest rates, they can inject much-needed confidence and liquidity into the economic system.

Decisive intervention now could mean the difference between a temporary market correction and a prolonged economic downturn. The Reserve Bank's leadership must recognize the urgency of the moment and be prepared to use their specialized powers to protect economic stability and restore market confidence.