Market Mayhem: Trump Tariff Tremors Send Wall Street into Freefall

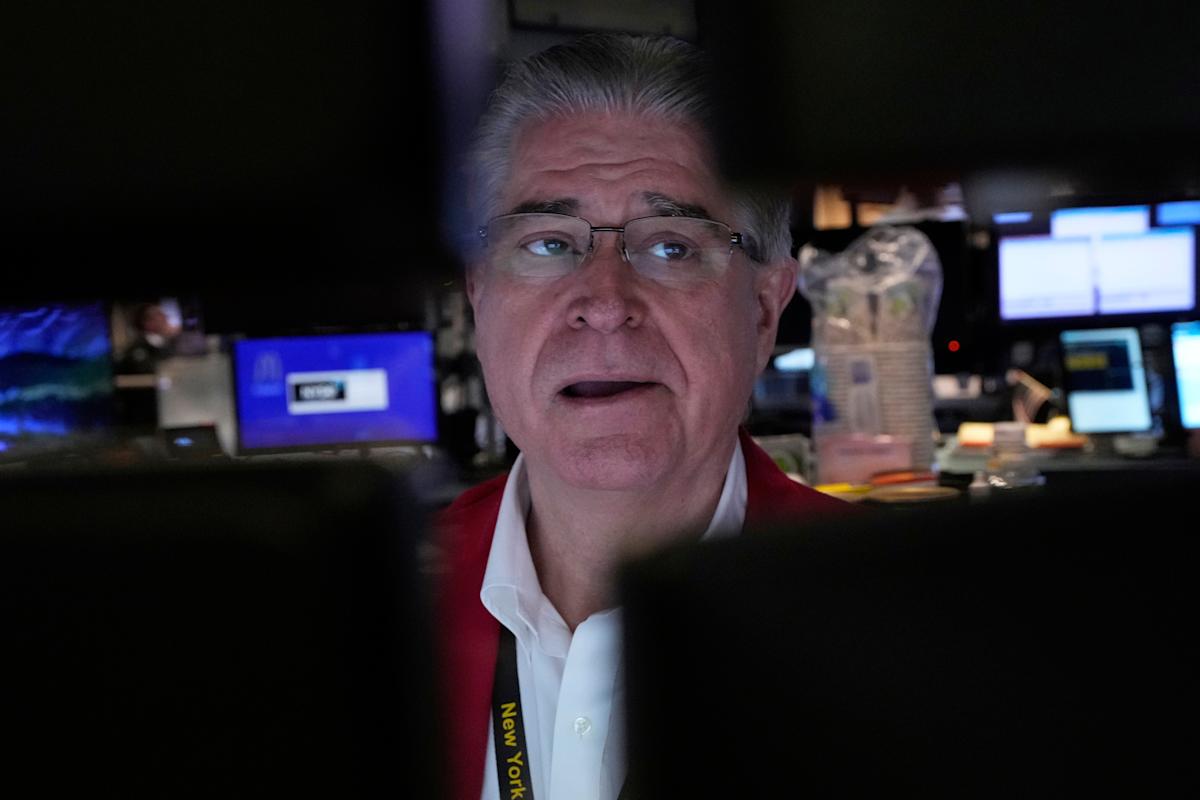

Wall Street Reels from Massive Market Selloff Triggered by Trade Tensions

Investors experienced a turbulent week as financial markets suffered their most significant downturn since the early days of the COVID-19 pandemic. The stock market witnessed a staggering loss of over $5 trillion in total market value, driven by escalating concerns over potential trade tariffs and economic uncertainty.

The dramatic market decline reflects growing investor anxiety about the potential economic impact of proposed trade policies. Uncertainty surrounding international trade relations has sparked widespread sell-offs across major indices, with investors rapidly repositioning their portfolios to mitigate potential risks.

The substantial market correction underscores the fragile nature of global financial markets and the profound influence of geopolitical tensions on investor sentiment. As traders and analysts closely monitor developing economic signals, the week's dramatic market movements serve as a stark reminder of the complex interconnections within the global financial ecosystem.

With billions of dollars in market capitalization evaporating in a matter of days, investors are bracing for potential continued volatility and reassessing their investment strategies in an increasingly unpredictable economic landscape.