Tech Titans Tumble: Why the 'Magnificent 7' Are Bleeding Investor Confidence This Quarter

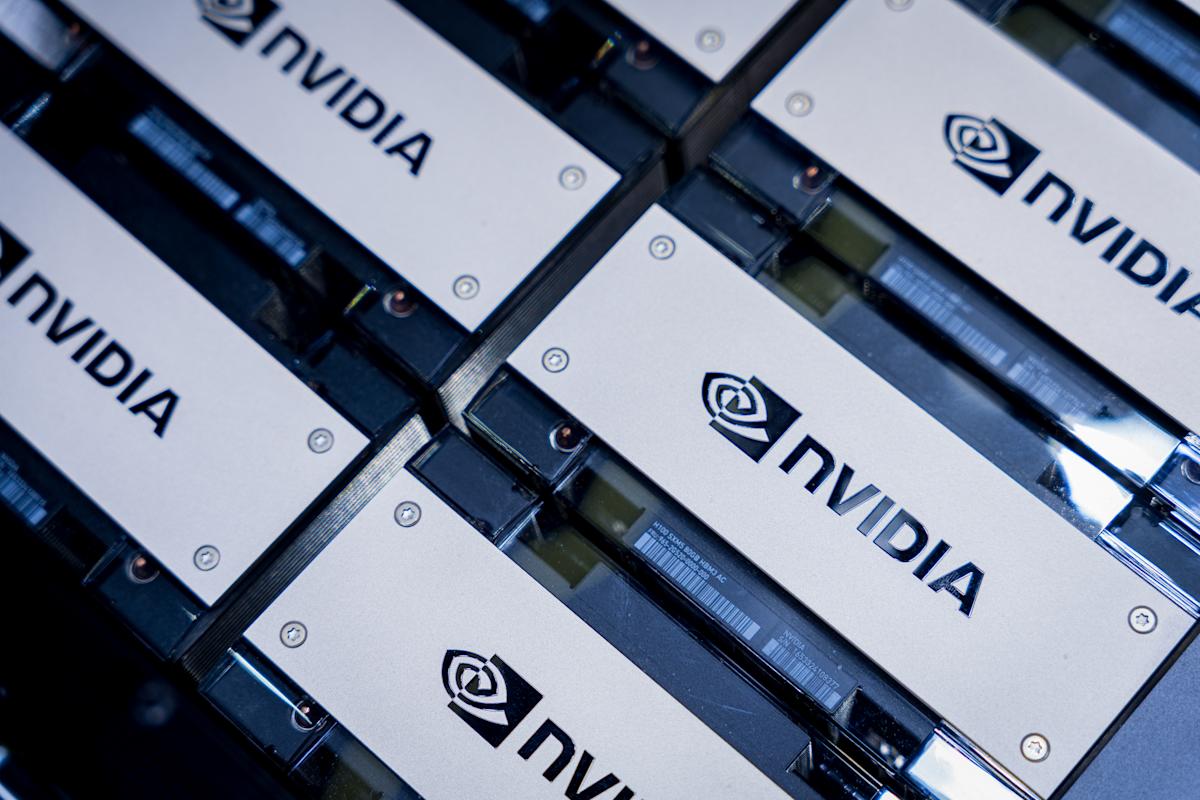

The tech titans that have been driving the stock market's remarkable rally are now facing a significant setback. The Magnificent Seven - a group of tech giants including Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla - are experiencing their most challenging quarter in over two years, and their struggles are sending ripples through the entire S&P 500 index.

These once-unstoppable stocks, which had been the primary engines of market growth throughout much of 2023, are now showing signs of vulnerability. Investors who had been riding the wave of artificial intelligence excitement and tech sector optimism are now witnessing a notable pullback.

The downturn is particularly striking given the group's previous stellar performance. After leading an extraordinary market rally earlier in the year, these tech behemoths are now experiencing a collective cooldown that's impacting broader market sentiment. Their declining values are not just a minor blip, but a significant drag on the overall market performance.

Factors contributing to this downturn include cooling investor enthusiasm, concerns about valuation, potential regulatory challenges, and a more complex economic landscape. The market is reassessing the seemingly unstoppable momentum these companies had been enjoying, signaling a potential shift in tech sector dynamics.

Investors and market watchers are now closely monitoring how these influential stocks will navigate this challenging quarter and whether this represents a temporary correction or a more fundamental change in their market trajectory.